| Crypto Users | 300+ million |

| Crypto Market Cap | $2.17 trillion |

| Traded Crypto Daily | $112 billion |

| Most Popular Crypto | Bitcoin |

| % Of Americans Who Own Crypto | 6% |

| Types Of Crypto | 6,000 |

| Country With The Most Crypto | India - 100 million users |

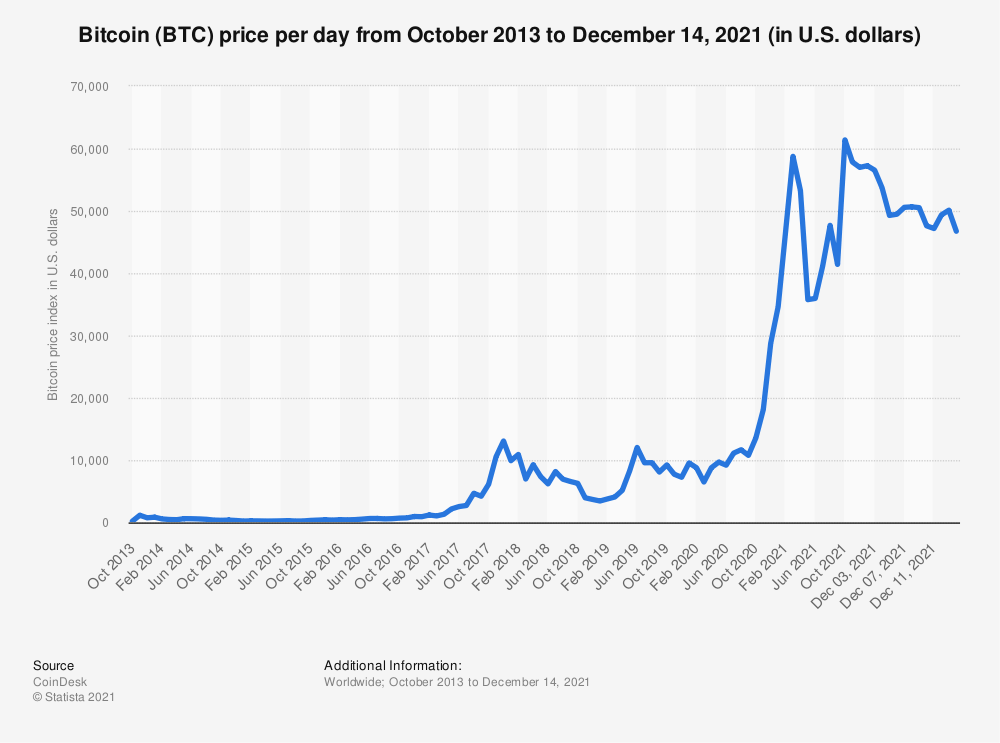

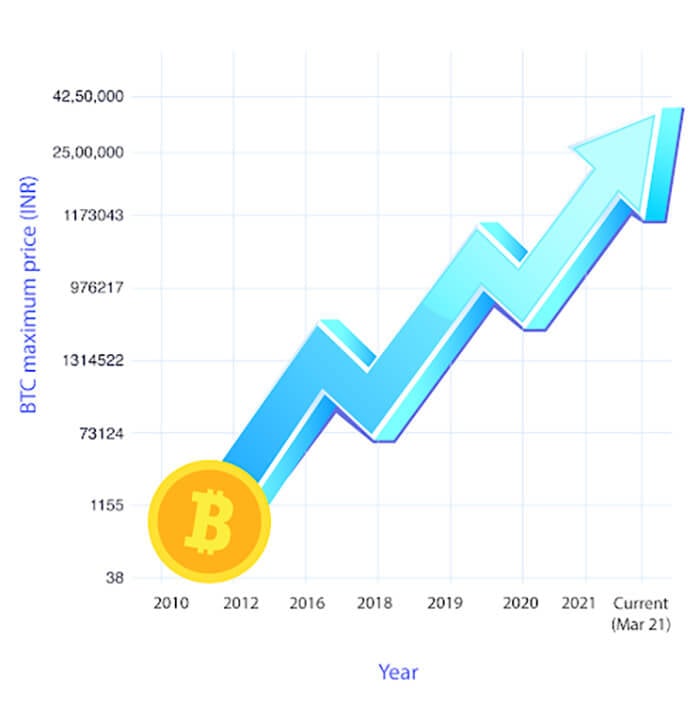

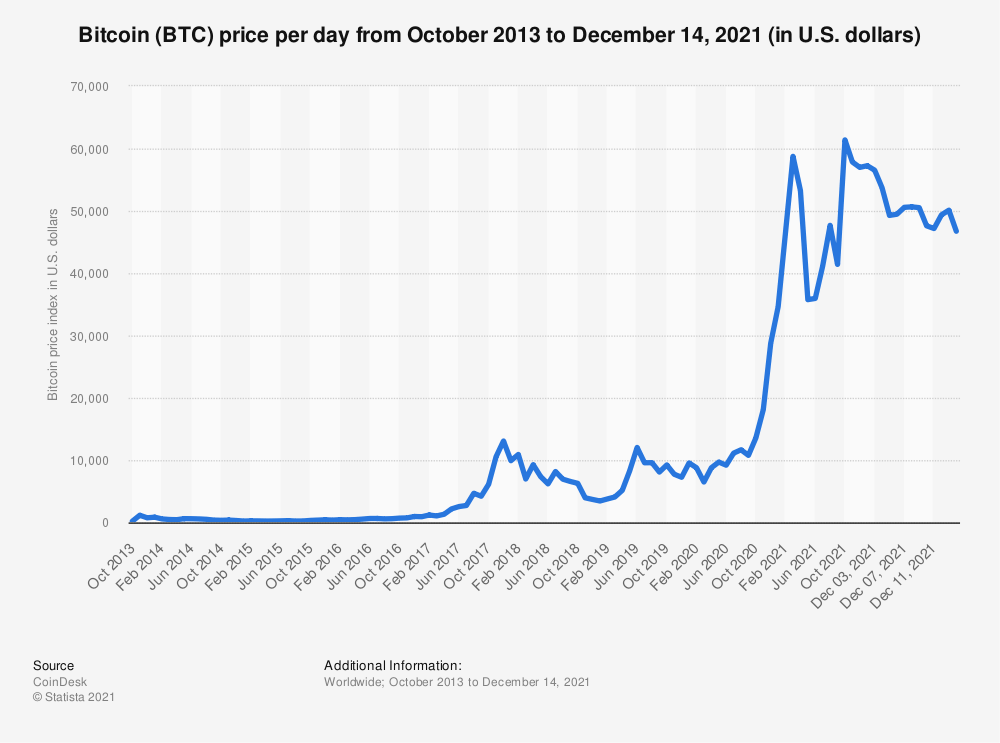

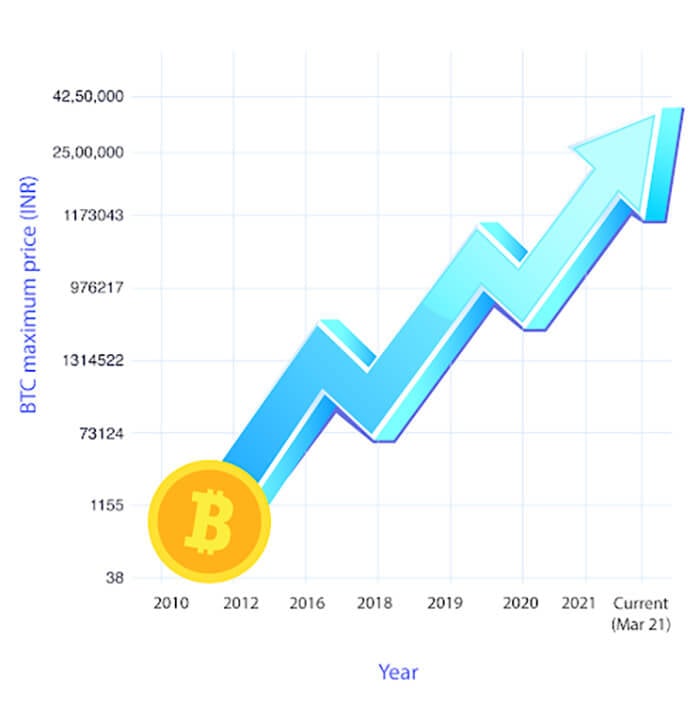

Between 2012 and 2021, the price of Bitcoin has increased by over 540,000%.

Bitcoin was the first cryptocurrency on the market. When it first launched, a $22 investment would now be $1 million today. That's how people have become billionaires through Bitcoin!

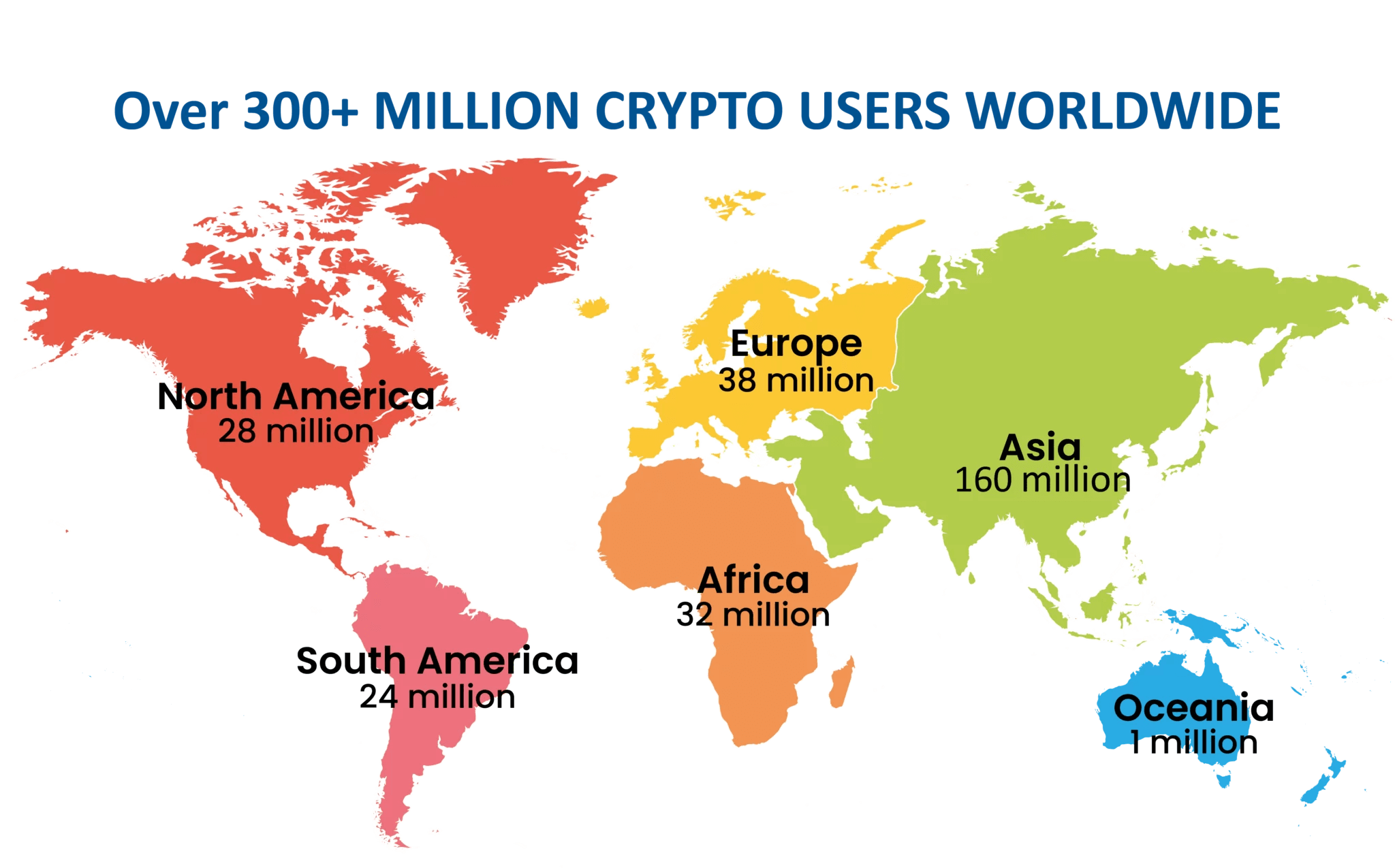

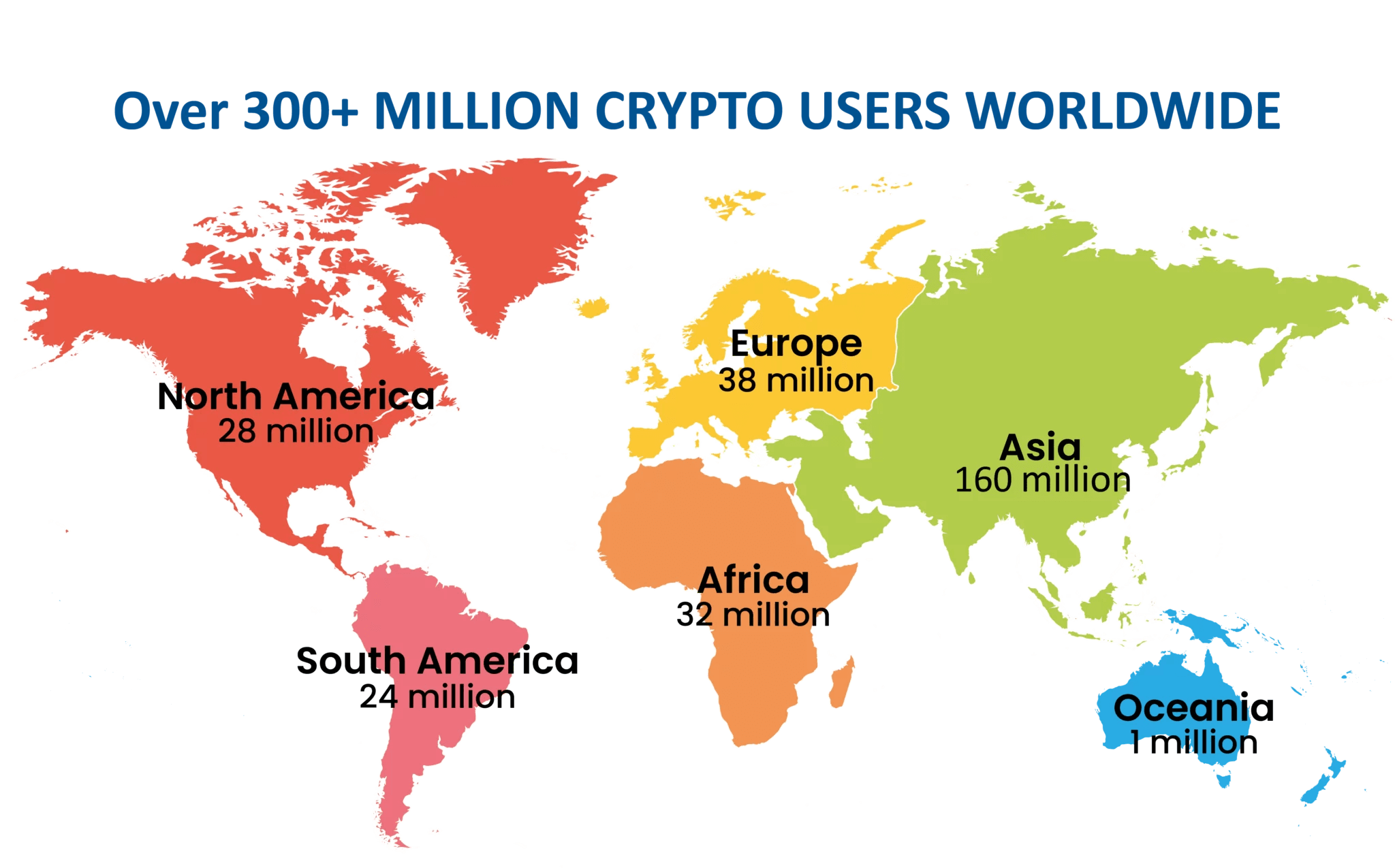

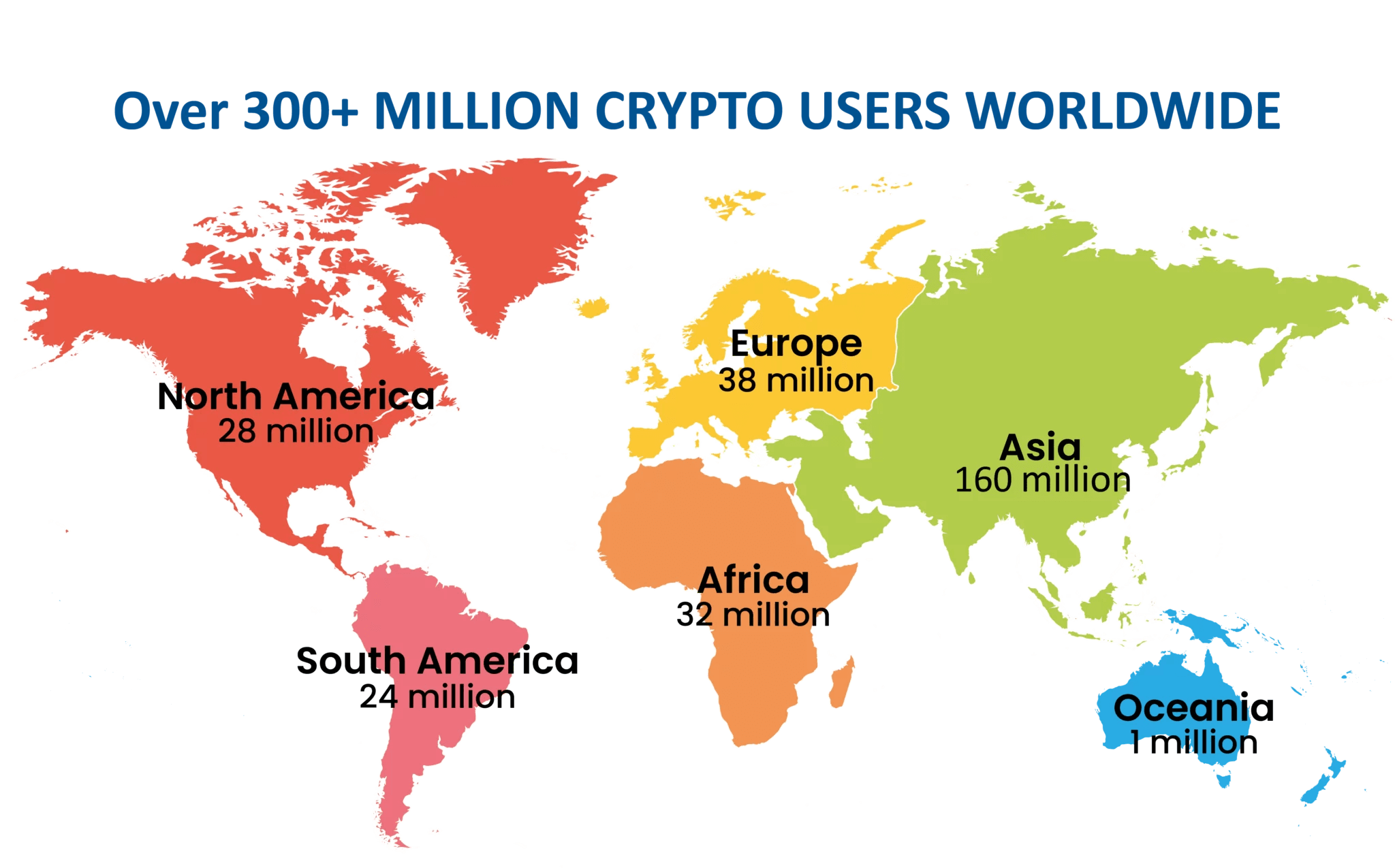

300+ million people around the world use/own cryptocurrencies in 2021.

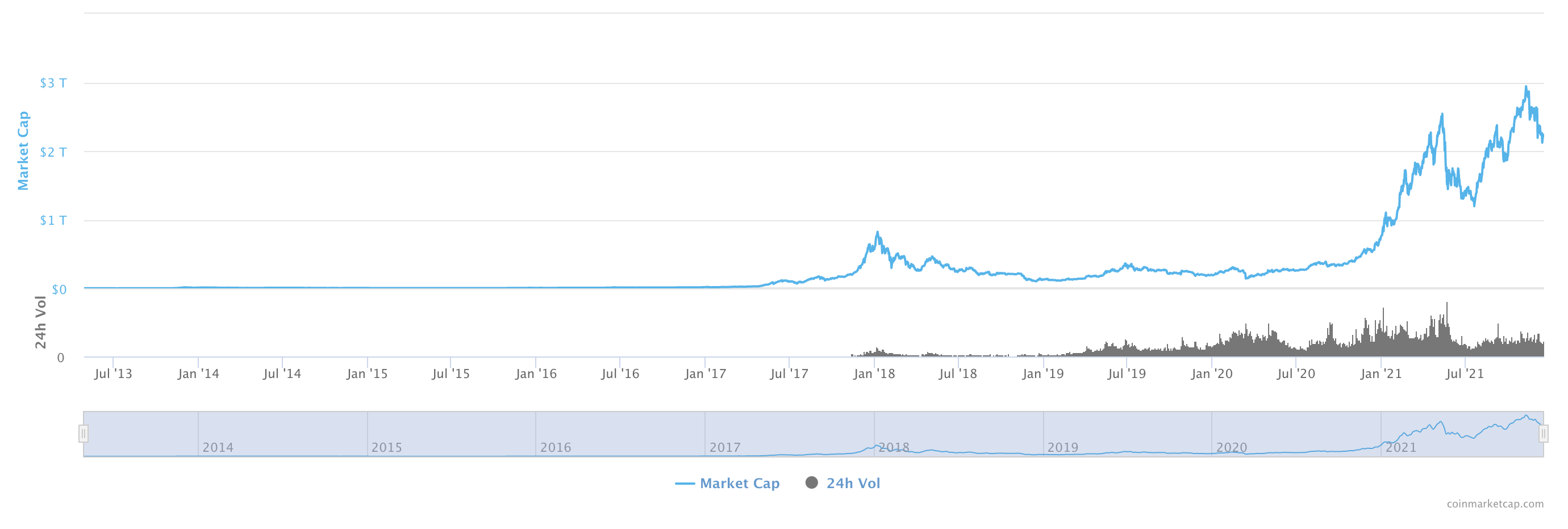

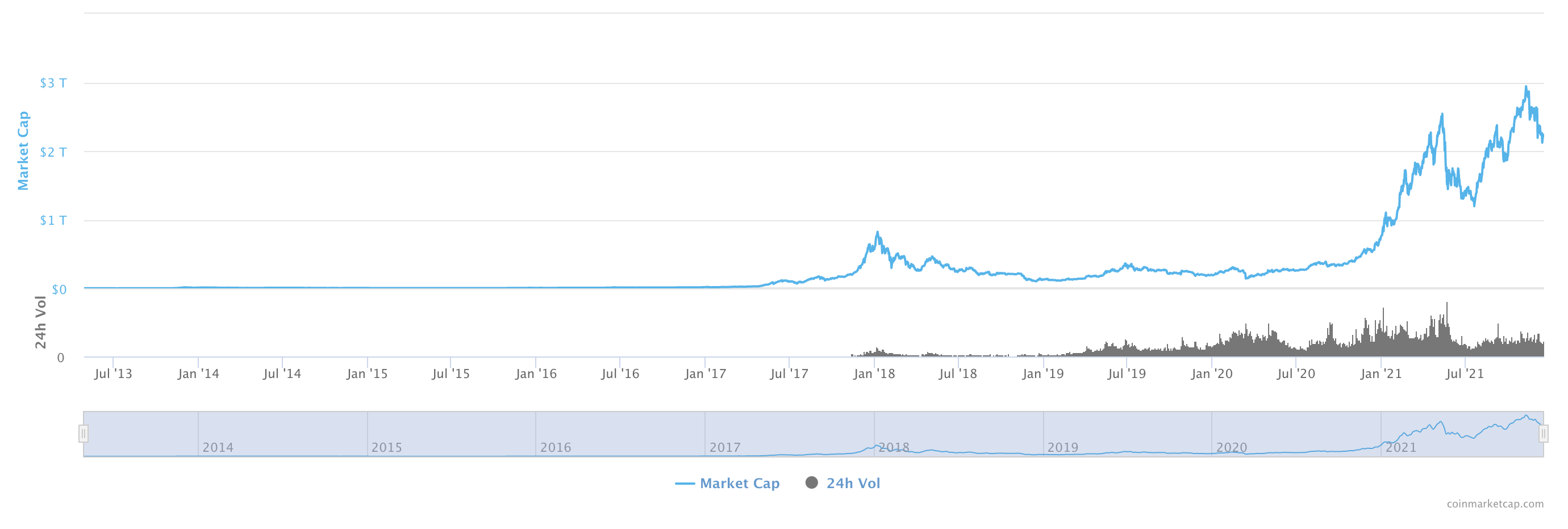

The global crypto market cap is $2.17 trillion as of December 17th, 2021.

This makes it the eighth largest economy in the world, if you're calculating based on gross domestic product. It's difficult to calculate how crypto stands up to global economics because it is specifically designed not to be a traditional country's currency.

Source: (1)

There have been efforts made by different countries to have capital gains taxes on crypto(4). Different legislation is involved in different areas.

Bitcoin alone has a market cap of about $600 million, which once reached over $1 trillion.

If you wanted to own every Bitcoin in existence, you would need hundreds of millions of dollars.

Approximately $112 billion is traded in cryptocurrency per day.

Source: (2)

65% of cryptocurrency users are bitcoin owners.

$22 invested in Bitcoin in 2012 would be $1 million today.

Source: (1)

The top 10 cryptocurrencies make up 88% of the total market value.

There are more than 6,000 different types of cryptocurrency.

Bitcoin is posted about on social media every 3 seconds.

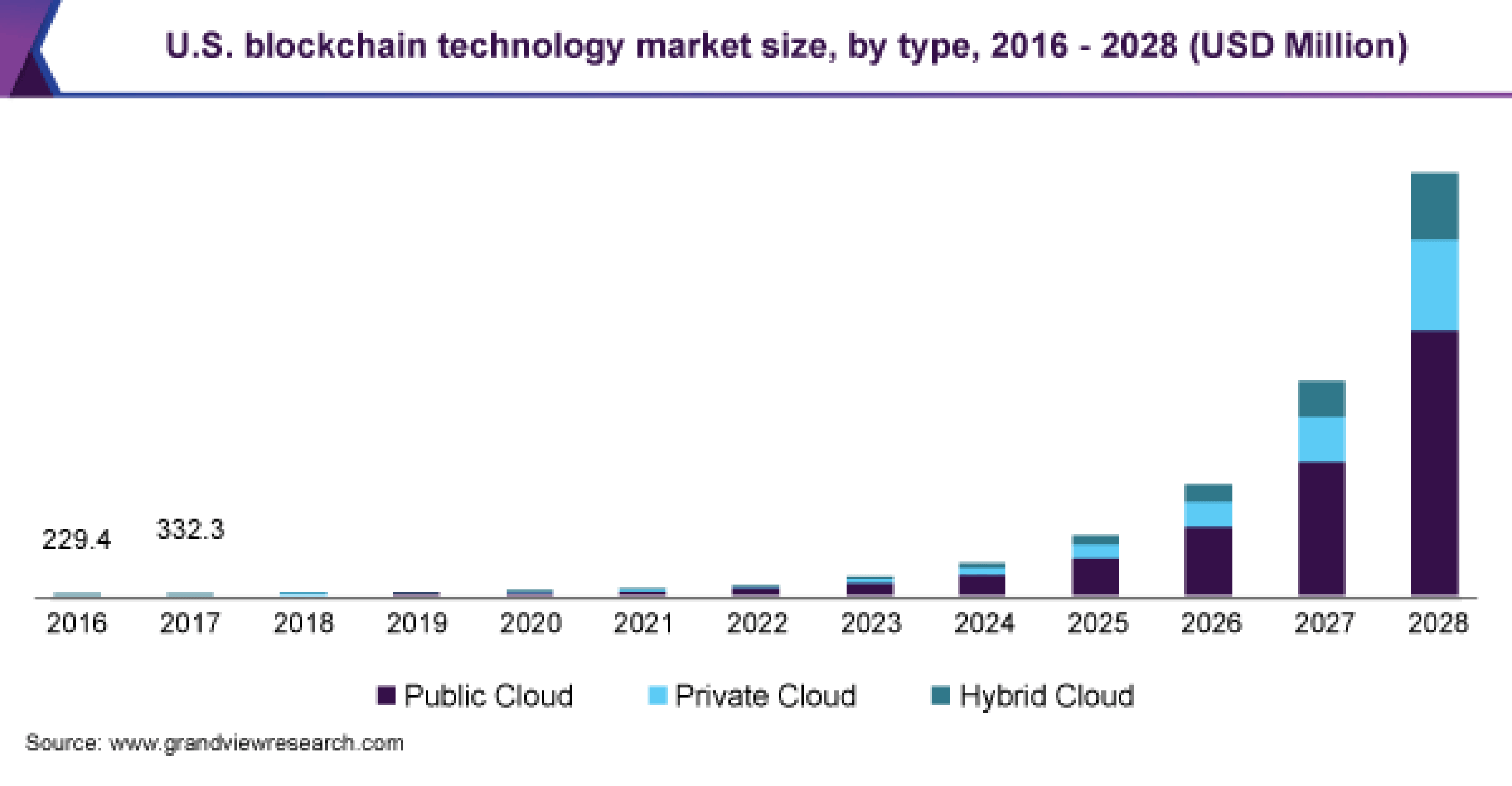

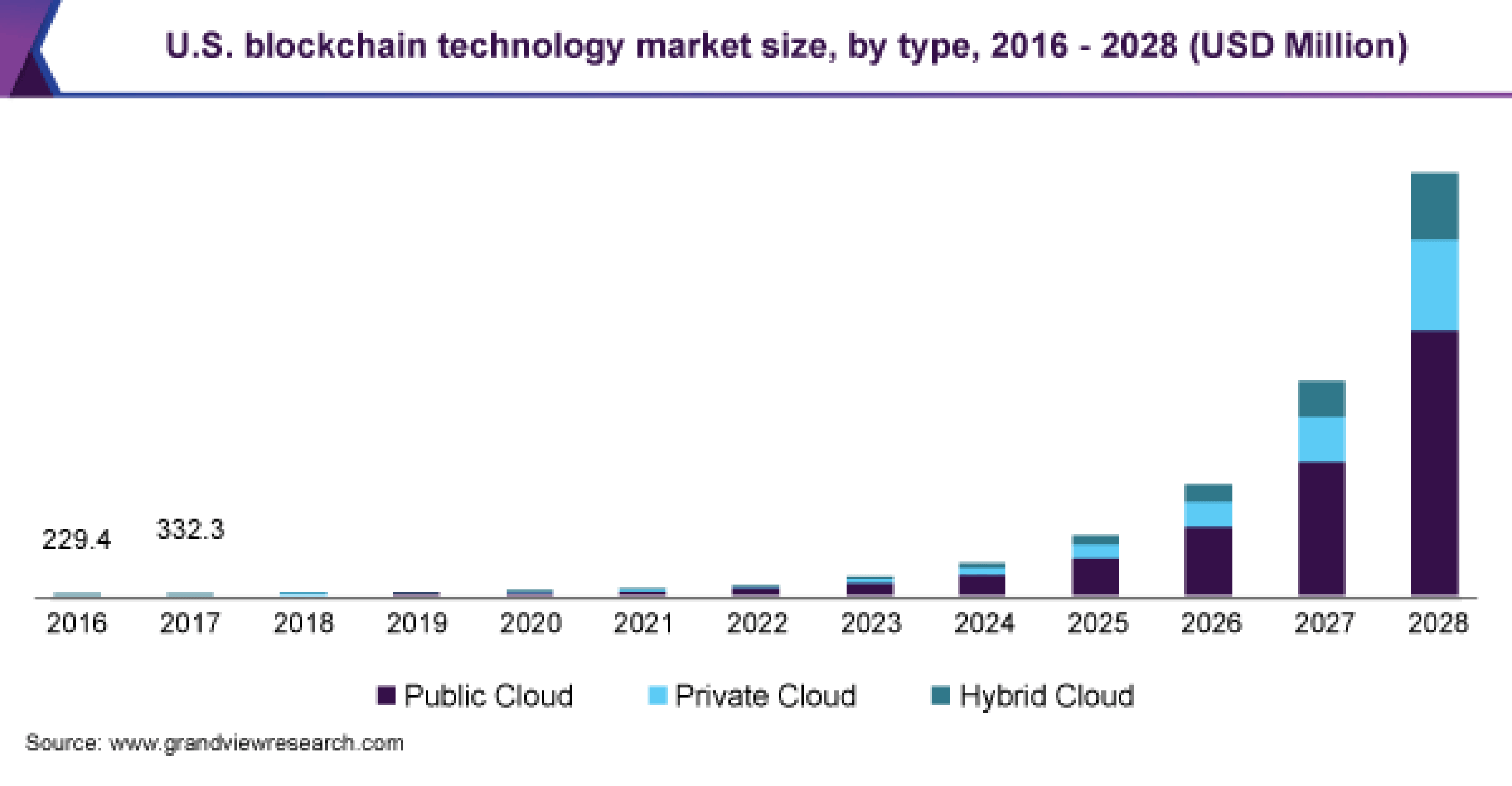

The global blockchain market will reach $23.3 billion by 2023.

Source: (3)

India has more cryptocurrency holders than any other country - more than 100 million.

Bitcoin had a market capitalization of $1,072.21 billion as of February 21st, 2021.

18,000 businesses are already accepting cryptocurrency payments.

There were more than 2,300 new cryptocurrencies launched in 2020.

ICOs, otherwise known as initial coin offerings, are the beginnings of new cryptocurrencies. Many of these are not able to last.

They need to establish that they have value based on the way they're mined and how they're used in transactions.

There are around 15,000 Bitcoin ATMs available around the globe.

Bitcoin ATMs allow people to trade cryptocurrency for regular currency.

When you go to a Bitcoin ATM, you can deposit cash of your global currency. Then you can purchase Bitcoin and sometimes other types of cryptocurrency.

You aren't able to withdraw physical funds, but you can input physical funds and make digital transactions with them.

Bitcoin holds about 66% of the total market share in the economy.

About 66% of the total value of the cryptocurrency market is tied up in Bitcoin. Other cryptocurrencies have tried to compete, but none have dominated yet.

Bitcoin had 100% of the market share when it first launched, and it had around 86% in 2015. That indicates that other currencies are slowly overtaking it.

In the world, there are 419 total spot exchanges specifically for cryptocurrency.

Spot traders allow crypto investors to trade with other holders on the spot. You can purchase or sell your cryptocurrency in real time. Most spot exchanges are digital.

80% of daily crypto trading happens in the top 10 exchange locations.

People are more likely to go to one of the better known exchange locations online or in person. Because these exchanges are so large, you're more likely to find a buyer or a seller with a low price there.

63% of daily crypto trading happens within the top 4 exchange locations.

The top four locations for spot exchanges dominate the market, making up the majority of trades in the industry. Their large size makes them difficult to ignore.

The total global revenue from mining crypto is over $20 billion annually.

Mining crypto is a time intensive process. Different cryptocurrencies have different methods of mining, usually involving solving a complex algorithm with a computer.

Those who mine crypto gain income from owning new cryptocurrency rather than investing in the existing market.

The blockchain has grown to more than 320 gigabytes in size.

The blockchain is the piece of data that keeps track of the ownership of every Bitcoin. It can tell you about when different Bitcoin changed hands and who owns what now. There is so much data that it takes up over 320 GB of space, and that number grows every day.

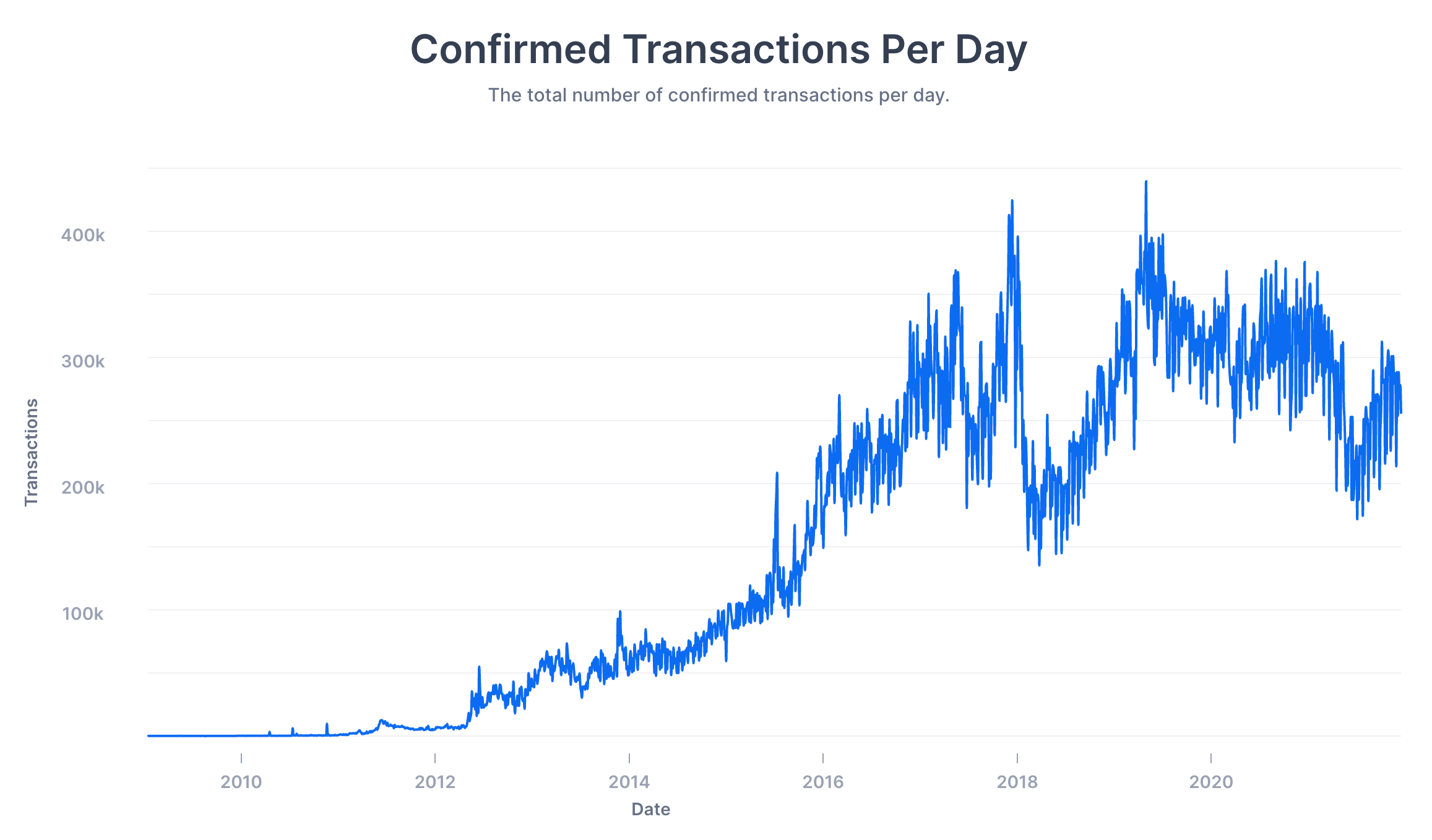

There were more than 120 million digital transactions conducted using Bitcoin in 2020.

Bitcoin makes up a substantial amount of digital payments. People have become more comfortable accepting and using virtual currency to pay for products and/or services in recent years.

Tesla was the first Fortune 500 company to announce that they'd acquire Bitcoin.

Tesla has become well known for electric cars. Tesla CEO Elon Musk was the first of the Fortune 500 CEOs to say that his company would be investing in Bitcoin.

However, due to the increasing demand for cryptocurrency, it's expected that other Fortune 500 CEOs will follow his lead.

Incidents of cryptocurrency theft increased in 2020 compared to 2019.

However, a larger amount of crypto was stolen in 2019 than in 2020.

There was a major hack in 2019 that led to the stealing of billions of dollars in cryptocurrency. In 2020, there were more hacks and thefts reported.

However, none of them were large enough to compare to the 2019 hack. In fact, 2020's losses to theft were 160% less than 2019's.

Almost $300 million worth of cryptocurrency was stolen during a hack in 2020.

Despite the large amount of stolen crypto, around 80% of that has been recovered.

This major theft was related to a KuCoin hack. But about 80% of the stolen assets have been returned. The hack did lead to concern about the stability of the crypto market, which caused some loss of value.

76 million people globally use blockchain wallets to store and encrypt their crypto.

A blockchain wallet is a type of digital wallet that holds not just Bitcoin, but all of the other cryptocurrency you own. The purpose of it is to make it easy to access your assets and to encrypt your data so you can't be hacked.

It costs up to $1 million to make an algorithm that's able to predict shifts in the crypto market and trade based on these.

Cryptocurrency is much harder to predict than the stock market, real estate market, or other more traditional assets. If you want an algorithm that can predict shifts, you'll need to be willing to invest a lot.

About 6% of people in the US own or have used crypto, while 32% of people in Nigeria say the same.

Nigeria has the largest crypto-using population, with about a third of individuals reporting that they have worked with cryptocurrency before. The United States is ninth on that list, since only about 6% of individuals have used this form of currency.

79% of Bitcoin investments come from men, and 21% come from women.

Analysts say there is a major discrepancy between the number of men and women who work with Bitcoin.

But with that said, more than 70% of women do say that they are aware of the existence of Bitcoin and cryptocurrency.

White respondents to surveys in the US have a higher awareness in general of Bitcoin than Hispanic and Black individuals.

But there is a significant amount of awareness of cryptocurrency in the Black and Latino communities in the US, particularly among younger people.

Two out of every three millennials believe that Bitcoin is a safer investment than precious metals like gold.

Precious metals are often used as a hard asset investment because they always have value. But millennials tend to trust in the value of Bitcoin and other cryptocurrencies more.

The process of mining cryptocurrency uses more electricity than the entire country of Argentina, leading to serious environmental concerns.

Energy consumption is a big issue for Bitcoin and other cryptocurrencies that use mining systems.

Bitcoin mining alone uses up enough electricity that more than 10 million homes could be totally powered for the year.

The mining is done by computers that work on complicated algorithms. Every time a new Bitcoin is "mined," the algorithm becomes more complicated.

If cryptocurrency was considered a country, its energy consumption would be in the top 30 in the world.

That's amazing because it means that mining uses as much energy as things like basic infrastructure, industrial needs, and commercial uses.

Tesla used more than $1 billion of environmental subsidies to purchase Bitcoin as of 2020.

The tax subsidies were due to the company's contributions to the environment. After investing in Bitcoin with these subsidies, Tesla started accepting Bitcoin payments when people wanted to purchase cars.

Carbon emissions from Bitcoin mining are larger than the emissions of all the activity in New Zealand.

That includes the residential, commercial, industrial, transportation, and power carbon emissions in the country. Wow!

The Bitcoin mining process uses up the same amount of energy as every global data center in the world combined.

Global data centers use about 185 TWh of energy combined to store electronic information. The entire Bitcoin network also uses up about that much energy annually.

Bitcoin mining actually produces more carbon emissions than precious metals mining every year.

Gold mining is notorious for being environmentally unfriendly, but it seems Bitcoin is not as bad.

Legislation in the state of Kentucky has been passed to give crypto miners tax and energy breaks.

Cryptocurrency miners in this state are no longer required to pay electricity sales tax if they purchased the electricity for their mining rig.

The carbon footprint of a single Bitcoin transaction is equal to more than 700,000 credit card transactions.

That's more credit card purchasing than the average person does in a lifetime!

The cost of electricity to mine Bitcoin every year comes to almost $4.5 billion worldwide.

Bitcoin mining might be great for electric companies, but it raises concerns about how the infrastructure can handle the power consumption.

A large amount of revenue generated by crypto mining is spent on electricity.

In total, crypto miners spend around 23% of their total mining income to maintain electricity for their rig. That's the biggest cost of a mining setup for most people.

GPUs are faster at mining Bitcoin than CPUs.

However, they also use more electricity than the central processing units that used to be used.

CPUs were the original units used to mine Bitcoin. But GPUs are faster. You need to have the fastest rig if you want to mine Bitcoin, so miners have switched over to these. Unfortunately, they use significantly more power.

Bitcoin mining has the potential to increase the global temperature more than 2°C.

This has led to a significant amount of outcry from environmental activists. Some Bitcoin miners are considering switching to nuclear power for a more sustainable mining setup.

Most of Bitcoin mining has occurred in China until the recent ban.

China recently announced that it intended to make Bitcoin mining illegal, which led to a sudden plunge in the value of the cryptocurrency.

Bitcoin creates more carbon emissions than the largest airline in the world, American Airlines.

It is one of the biggest polluters on the globe, ranking among some of the top corporations worldwide.

If you purchase $50,000 worth of product with Bitcoin, the carbon footprint is about 270 tons.

That's the equivalent of around 60 heavy duty cars. It's hard to conceptualize just how much energy that uses.

Bitcoin gains are estimated to be massively underreported on taxes in the US.

The IRS recently stated that people have underreported their earnings from crypto, even though you legally must disclose them.

In 2015, there were only about 800 tax-reported Bitcoin transactions in the US.

There may have been more than 800 transactions in the country, but that's the number reported on tax returns.

In 2019, it's estimated that less than 150,000 people documented their cryptocurrency gains or losses on their tax returns.

The IRS intends to work on more specific guidance for how people need to document their cryptocurrency holdings.

30 countries have guidance on how cryptocurrency should be classified on your taxes.

This makes it much easier for people to declare their investments and pay the appropriate taxes.

In 2020, there were 12 countries that had specifically banned people from owning, investing in, or making transactions using cryptocurrency.

This number has risen in 2021, and it may continue rising with the environmental concerns about crypto.

Indonesia and Ecuador both ban business owners from accepting cryptocurrency as a payment form.

The other countries banning crypto may allow it to be accepted as payment from holders in countries where it is legal.

There are 24 countries that do not consider cryptocurrency to be the same as traditional currency.

Cryptocurrency is classified differently from traditional currency in these countries, considered an investment rather than a form of payment.

Cryptojacking is one of the biggest cybersecurity threats.

In fact, many people's computers are used by hackers to mine crypto against the users will.

Malware can be installed on computers and other electronics that is then used to mine cryptocurrency without paying for the electricity.

In 2020, there was a cost of nearly $2 billion in cryptocurrency related crime.

This was a massive amount of crime, with most of it being related to fraud and theft.

Two groups of hackers have claimed to be responsible for more than 50% of all cryptocurrency theft in the world.

They stated that they had stolen about 60% of assets that people had reported missing. These hackers are considered some of the most prolific and skilled in the world.

Some analysts estimate that anywhere from 50 to 80% of cryptocurrencies were launched as a means of committing fraud.

Initial coin offerings are sometimes just a way for developers to fraudulently gain people's money. You should be careful about the crypto you invest in from the ground-up.

Defrauding and exit scams are tragically common in the crypto world.

For example, there was a Ponzi scheme in 2019 that defrauded people of almost $3 billion

Schemes to defraud people have existed in every form since the dawn of time. Now they've been reimagined for the digital world.

The most common crime related to cryptocurrency is fraud, with about 73% of criminal activity meeting this guideline.

Fraud might involve fraudulently representing your assets or claiming to sell someone something that isn't actually real.

About 50% of all thefts of cryptocurrency in 2020 were related to DeFi hacks.

DeFi hacks targeted cryptocurrency holdings. This had a serious impact on the credibility of Decentralized Finance.

In 2020, more than $40 million in Bitcoin was stolen or defrauded by criminals.

When compared to the billions of dollars available in Bitcoin, though, this number seems lower. It's a fractional percentage of the entire market.

In 2020, there was $3.5 billion in cryptocurrency sent to digital wallets that were later marked as being involved in criminal activity.

Not all of the criminal activity was necessarily related to the cryptocurrency, though.

Asia is the continent with the largest number of crypto users globally (160 million).

Frequently Asked Questions

These are some of the most common questions about the cryptocurrency industry.

What are the cryptocurrency demographics?

Let's take a look at important crypto demographics:

| Age | 58% of crypto holders are under 34 years of age. |

| Gender | 79% are male and 21% are female. |

| Education | 82% have a bachelor’s degree or higher. |

| Income | 36% have an annual income of $100k or more. |

What are the top cryptocurrency apps?

| Coinbase | Largest cryptocurrency exchange by registered users |

| Binance | Binance is the largest exchange, responsible for more than $1 trillion annual volume in 2020 |

| FTX | One of the newest exchanges which is popular in the sports industry |

| Cash App | Mobile payments app which has generated over $4 billion in 2020 Bitcoin revenue. |

| eToro | A large stock-trading app based in Europe which made 61% of its revenue from crypto in 2021. |

| Robinhood | A stock-trading app which transitioned to cryptocurrency. |

| Revolut | A European financial super-app which added a crypto exchange in 2020. |

| Kraken | One of the most established crypto exchanges in the cryptocurrency industry. |

| Crypto.com | Popular crypto exchange which offers users a crypto debit card, NFT marketplace, and a DeFi wallet. |

| Luno | Luno markets itself to developing countries while supporting hundreds of fiat currencies. |

| WazirX | India's largest crypto exchange. Binance acquired WazirX in 2020 for $150 million. |

How many people use cryptocurrency?

Cryptocurrency has become more and more common in recent years. In 2021, there are more than 300 million users of cryptocurrency around the globe. That means that about 3.9% of the population owns some form of cryptocurrency.

In addition, there are thousands of businesses that accept cryptocurrency payments. Those numbers are expected to grow as more and more businesses see the value of the market.

How many cryptocurrencies are there?

Though Bitcoin and Dogecoin might be the best known cryptocurrencies, there are actually many more than that. In 2021, there are more than 6,000 different currencies.

The value of these varies widely. Some might become worthless within a few months, while others might be lucrative investments.

This is a huge increase over the last decade. In 2011, cryptocurrency was almost unheard of. In 2013, there was just a tiny handful of different electronic currency available.

What is the market size of the cryptocurrency industry?

The global market for all cryptocurrency is valued at around $1.5 billion. However, it is expected to explode in value over the next decade.

By the time 2030 rolls around, the market is expected to be worth almost $5 billion.

Which cryptocurrencies will be the most valuable remains to be seen. But this is definitely a growing industry with growing consumer demand.

What is Bitcoin’s market capitalization?

The market capitalization for Bitcoin changes on a minute to minute basis. As of June of 2021, the market capitalization was around $600 billion.

While that is an enormous amount, it's actually a decline. At its peak in April of the same year, Bitcoin had a market capitalization of over $1 trillion.

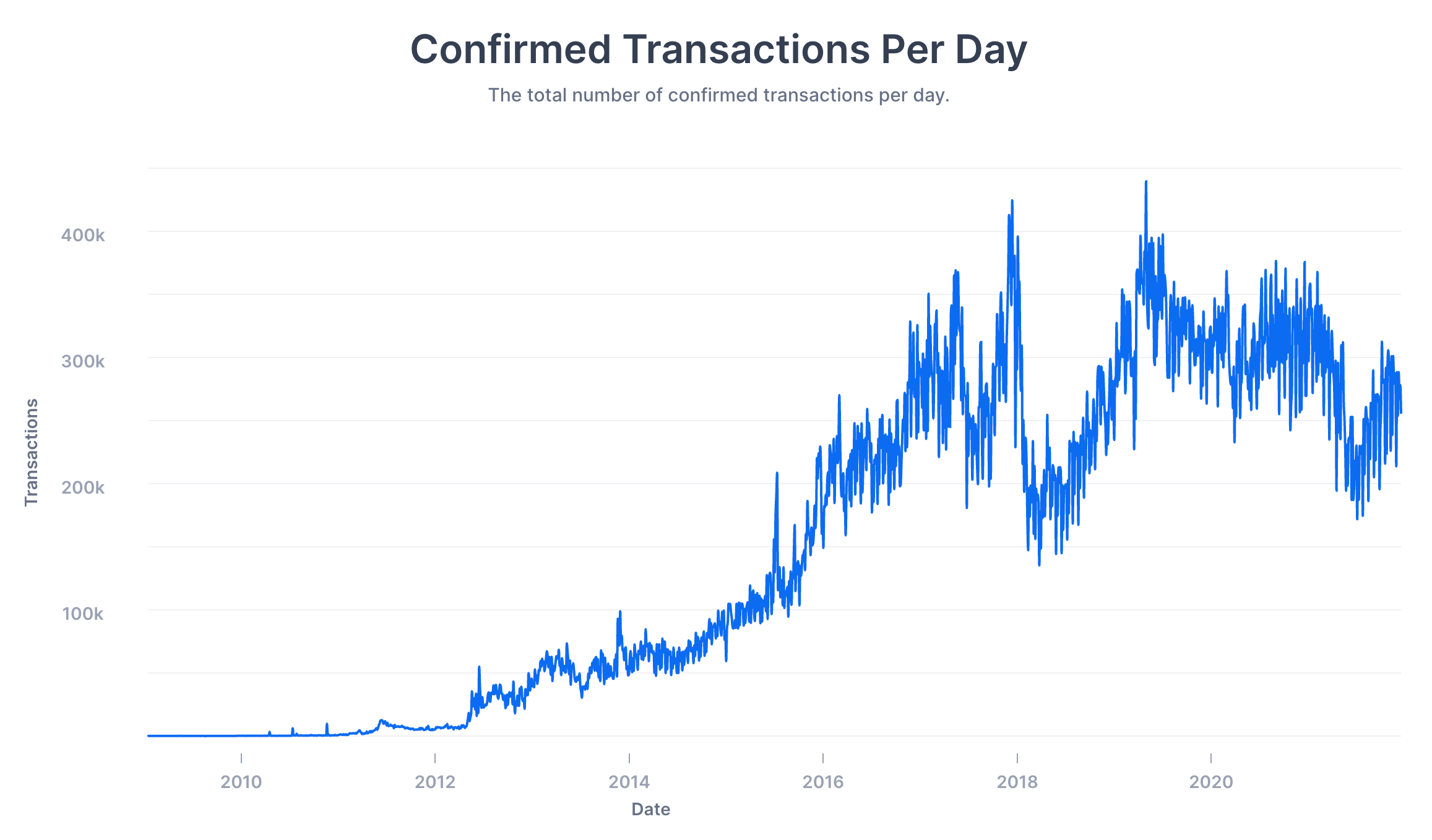

How many daily Bitcoin transactions are there?

The peak of daily Bitcoin transactions was in December of 2020 and January of 2021. As of January, there were about 400,000 different transactions happening per day.

While this was a larger amount of transactions than some currencies, it paled compared to Ethereum.

In September of 2021, the daily Bitcoin transactions hovered around 250,000. On some days, the number dipped below 200,000, while on others it neared 300,000. The number of transactions seemed to vary depending on the news about Bitcoin's value.

On days when Bitcoin was going up in value, people were holding onto their coins. But when the coin was losing value, people used it to make purchases.

Which country has the most cryptocurrency?

The top 5 countries with the most cryptocurrency holders are:

- India (100 million)

- USA (27 million)

- Nigeria (13 million)

- Vietnam (5.9 million)

- United Kingdom (3.3 million)

Which cryptocurrency has the most users?

Bitcoin has the largest number of users, though most people own just a tiny fraction of a single coin. It was the first cryptocurrency to hit the market, and it remains the best known. Stores that take cryptocurrency are more likely to take Bitcoin than other forms of digital payment.

The next most used type of cryptocurrency is Ethereum. This one is interesting because it is more often used the same way traditional currency is. People use their holdings to make purchases and accept payments. With Bitcoin, it's more common for people to be making a long term investment instead.

What is Bitcoin’s market share?

Bitcoin has a massive market share when it comes to cryptocurrency options. In fact, it holds more than 66% of the market capitalization. That leaves just 34% to be spread among all the other crypto options.

For the most part, Bitcoin is significantly more valuable than other cryptocurrencies. It has a level of scarcity due to its mining system.

The 66% is actually a decrease, though. When the coin first started out, it was the only type of digital currency and held a 100% market share. As of 2015, Bitcoin had an 86% market share, with just a few other options competing.

The downward trend seems to indicate that other cryptocurrencies are fighting for space in the Bitcoin market. This single digital currency won't always be the most dominant option available.

What percentage of the world is invested in cryptocurrency in 2021?

In 2021, about 3.9% of the population has some ownership of digital currency. That amounts to around 1 in every 25 people, with over 300 million individual investors total.

Some countries have higher numbers of investors than others. For example, in Nigeria, about 1 in every 3 people either own or have recently used cryptocurrency.

By continent, the largest number of crypto users is in Asia. There are more than 160 million users there. The next most crypto-heavy continent is Europe, which has just 38 million users. Africa comes in third with 32 million.