We may receive advertising compensation when you click certain products. Before jumping into this page, an important disclosure.

We've listed the top crypto exchanges in Mexico. These exchanges offer the ability to buy crypto and Bitcoin in Mexico.

Paybis is a popular cryptocurrency exchange. They serve 180 countries and 48 US states and are registered with FinCEN, making them a more trusted, regulated exchange. Paybis offers incredibly high limits and super fast payouts, not to mention 5 minute ID verification and nearly perfect review scores on Trustpilot.

Airtm offers a peer community. You can buy and sell dollars or crypto in exchange for other forms of value. The platform provides trust and transparency by authenticating users and establishing a higher degree of identity validation to the peers who facilitate the transactions. Airtm provides an escrow system, so that value exchanges are fair and are completed as agreed.

Bitex.la is a Bitcoin exchange and broker which services many South American countries, including Brazil, Mexico, Argentina, Chile, Peru and Uruguay. You can fund your exchange account with cash or AstroPay.

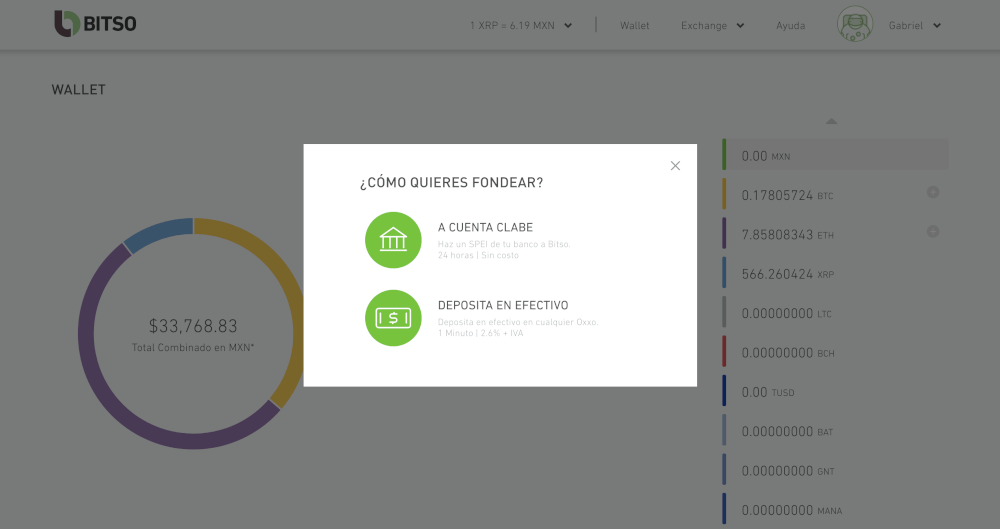

Bitso is a Bitcoin exchange based in Mexico. You can fund your account with SPEI Transfer or via cash deposit using Oxxo or any 7-Eleven in Mexico. They offer additional withdrawal methods.

Volabit is a Bitcoin exchange based in Mexico. You can fund your account via online bank transfer or by cash deposit at any 7-Eleven, Farmacias Benavides, Farmacias del Ahorro, or Extra.

You can use our Bitcoin ATM map to buy bitcoins with cash. Bitcoin ATMs can be a quick and easy way to buy bitcoins and they're also private. That convenience and privacy, however, comes with a price; most ATMs have fees of 5-10%. View Bitcoin ATMs

-

We maintain our own collection and database of Bitcoin ATM machines in Mexico. Here is a list of the ATM machines we've collected. You can submit a Bitcoin ATM teller to us by using our contact form.

-

-

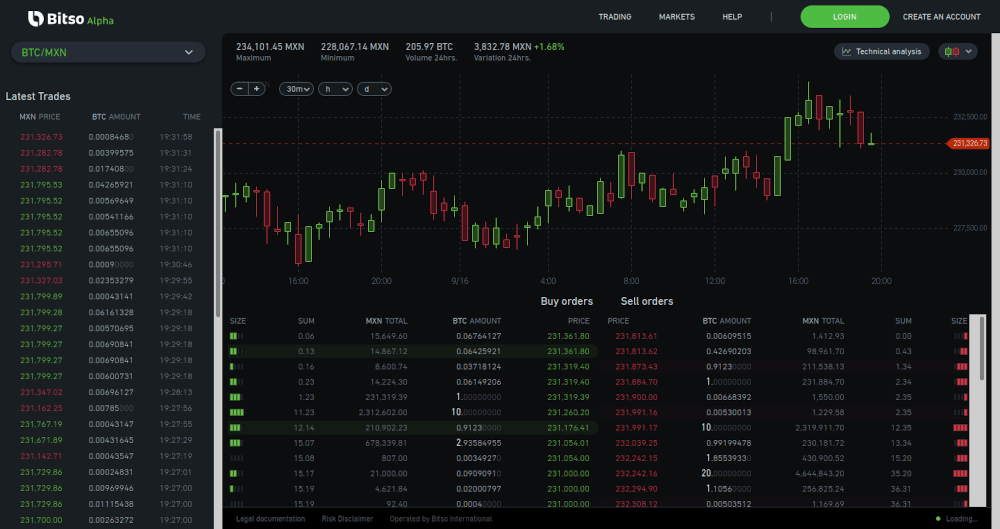

Bitso is the largest Mexican exchange, serving over 80,000 customers in Mexico and more than half a million across Latin America. Bitso offers a full suite of trading products, including a beginner-focused offering as well as Bitso Alpha, which is targeted to advanced and professional traders.

With 206 BTC of 24 hour trading volume on the BTC/MXN pair, there is ample liquidity for small to medium sized traders and investors.

As proof of its commitment to broadening its services across Latin America, Bitso also has a Bitcoin/Argentine Peso (ARS) trading pair.

Bitso allows you to fund your trading account via bank SPEI transfers, or via OXXO Pay.

Bitso's mobile app is available on the Apple App Store as well as the Google Play Store.

Depending on the specific trading pair, Bitso's fees range from very competitive to relatively high.

Fees for Mexican peso (MXN) markets - i.e. BTC/MXN, ETH/MXN, etc. - start at 0.65% for taker orders on accounts with less than 1,500,000 MXN 30 day trading volume.

BTC market - i.e. ETH/BTC - fees start at 0.098% and go as low as 0.05% for traders with >950 BTC 30 day trading volume.

Taker fees on Argentine Peso (ARS) markets start at 0.6% for taker orders and 0.3% for maker orders.

Cryptocurrency deposits are free of charge. Withdrawals can be somewhat pricey - withdrawing DAI to an external wallet currently incurs a fee of 4.56 DAI - though this is not far above the industry average.

Bitlem is a Mexico City based exchange.

Bitlem's head office, which also houses a physical over-the-counter trading desk, is just across the road from the Mexican stock exchange (la Bolsa Mexicana de Valores). Clients can walk in and buy Bitcoin in a face to face transaction with a real person, something which the company says is appreciated by many first time Bitcoiners.

What the majority of new people to the Bitcoin ecosystem want are security, trust and customer support. This is why we decided that it was important to launch our company with an office and telephone lines open to the public. This way, our clients come to our office or call us to ask questions or to find help to solve their doubts and problems; and above all, buy and sell Bitcoins with the confidence that they will always have a human face willing to help them.

Jorge Chavez Martinez General Director, Bitlem

Jorge Chavez Martinez General Director, BitlemWith 0.1% fees on all trades, telephone support, and a professional traders' platform, Bitlem is going after all corners of the market.

-

Coinbase is available in Mexico.

Mexican users can buy cryptocurrencies and convert between them. Credit and debit cards are the only supported payment methods, meaning no bank transfers or PayPal.

Bitcoin ATMs are a convenient way to buy and sell Bitcoin and other cryptocurrencies for cold hard cash. This method usually incurs relatively high (5-10%) fees, but that's the price to be paid for the convenience of getting cash for your Bitcoin in less than half an hour.

Many ATM operators publish live prices for their machines, so you can see the exact rate you'll get before even visiting the ATM.

Some will require you to complete identity verification, though for many this is as simple as confirming a phone numer.

Our Bitcoin ATM Locator lists 10 Bitcoin ATMs in Mexico. Mexico City is home to four Bitcoin ATMs, Culiacán two, and Guadalajara, Monterrey, Santiago de Querétaro and Tijuana one each.

Yes, there are a number of ways to buy bitcoin in Mexico using PayPal.

However, there are a number of things to take into account when buying Bitcoin with PayPal.

PayPal is notorious for payment disputes, meaning sellers often add large markups to offset the risk of having the payment reversed. Also, varying slightly depending on you and the counterparty's countries of origin, there will be a roughly 3% fee to take into consideration.

Peer-to-peer marketplaces such as LocalBitcoins, and LocalCrypto all support PayPal as a payment method.

That sums up the major P2P marketplaces where you can buy Bitcoin using PayPal. Be sure to thoroughly read the terms of trade before opening one, and check the seller's price of Bitcoin vs the spot price as the markup can sometimes be drastic.

Yes, you can buy Bitcoin using cash in OXXO stores.

OXXO is a non-bank post-payment platform that allows users to pay for online services at any of the 18,000 OXXO stores in Mexico. At checkout, a customer can select OXXO and receive a barcoded document that represents the balance owed. This voucher is valid for three days, and can be paid in cash at any OXXO store.

The simplest way to buy Bitcoin using an OXXO invoice is to create an account with Bitso, a Mexico-based exchange with more than half a million customers in Latin America.

Once you've opened an account, you can deposit pesos to your balance using OXXO. Then, purchase Bitcoin or any other supported asset (ETH, BAT, MANA, TUSD, XRP, LTC, BHC, and GNT).

Deposits using Oxxo take less than a minute to appear in your account and are subject to a 2.6% fee by Bitso plus IVA.

If for whatever reason you do not wish to open an exchange account, there are other ways to buy Bitcoin using OXXO.

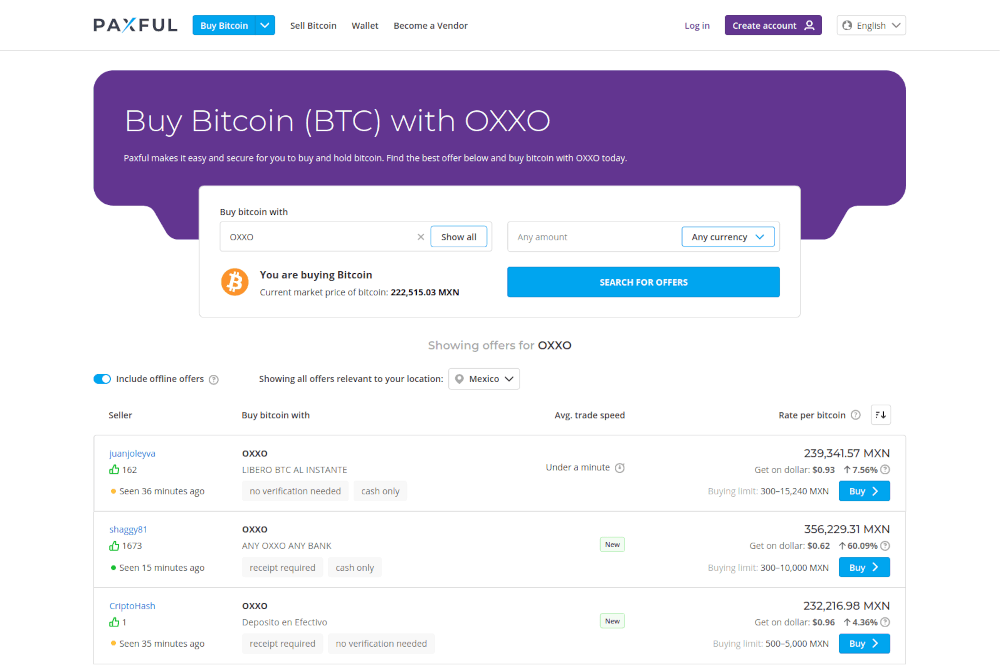

Paxful is a peer-to-peer (P2P) marketplace where you can buy and sell Bitcoin with other individuals.

And there are a number of people selling Bitcoin for OXXO Pay.

When using P2P exchanges, be sure to always read the counterparty's terms of trade, and always use the platform's escrow service.

Bitcoin - as an un-confiscatable digital asset that is accessible wherever there is internet - is ideal for remittances.

The process of sending Bitcoin from one address to another is identical regardless of where the sender and recipient are located. There are no extra steps required that make sending Bitcoin internationally any different to sending it next door.

Likewise, the blockchain fee you will need to pay in order to have your transaction sent is the same, whether you're sending to the other side of the world or just another of your own wallets.

Bitcoin debit cards are a very convenient product born from the combination of the crypto world and legacy finance. They allow you to load crypto (almost always Bitcoin, and often with other supported assets like ETH or DAI) and spend it anywhere that debit cards are accepted. If the crypto is not automatically converted to fiat at the time of payment, you will need to pre-convert it, usually within your card provider's app.

Most cards issued are Visas, though recently MasterCard has been accelerating its offerings in the space and in July partnered with Wirex - a crypto card service.

There are a range of providers out there, and most of their products are relatively similar. As card issuers generally take the same cut of transaction fees - with their share called the interchange - there is little room for much difference on pricing, fees, etc. Differences arise more often based on the country in which the parent company is located.

This means that it's mostly a matter of picking which provider best serves your locality.

That said, not all card issuers serve Mexico. Options are more limited than in the US or EU, with Europe especially being spoiled for choice with options like non-custodial decentralized payment providers.

| Cryptopay | No |

| MCO | No |

| Revolut | No |

| Uquid | Available to existing Uquid customers in Mexico |

| Wirex | No |

Bitpay's offering will be hard to beat once it is released, while Uquid's debit card is the only option in Mexico right now. With Revolut's recent expansion into the U.S., it's worth keeping your fingers crossed that Mexico will be the next market for the fintech pioneer.

The above-mentioned Bitcoin debit cards allow you to withdraw cash from any ATM.

Bitcoin ATMs are another way to exchange your BTC for fiat currency.

You can use our Bitcoin ATM finder tool to find the one nearest you.

Perhaps the most straightforward way is to use any exchange that has a BTC/MXN trading pair, such as Bitso or Bitlem, which are reviewed above. You can sell your Bitcoin for pesos, and then cash out those pesos to your bank account.

LocalBitcoins and other P2P exchanges are another option. Here, you can buy and sell Bitcoin for a wide range of payment methods, from gift cards to bank transfers. LocalBitcoins is a peer-to-peer (P2P) exchange, where you buy and sell with another individual. This does introduce a degree of risk, though by ensuring that you conduct all business on the platform, make use of its escrow services, and only trade with users who have a good reputation, you'll minimize any potential problems.

As selling Bitcoin for fiat currency is usually considered a taxable event, you'll want to make sure you comply with local regulations regarding taxation of capital gains. Check out our guide to the best cryptocurrency tax software to help you maximize your profits.

BuyBitcoinWorldWide writers are subject-matter experts and base their articles on firsthand information, like interviews with experts, white papers or original studies and experience. We also use trusted research and studies from other well-known sources. You can learn more about our editorial guidelines.