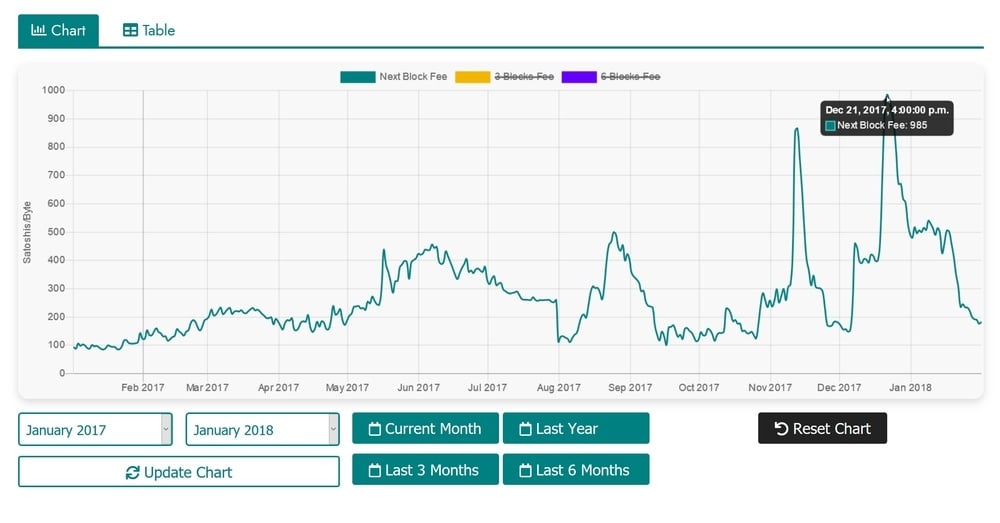

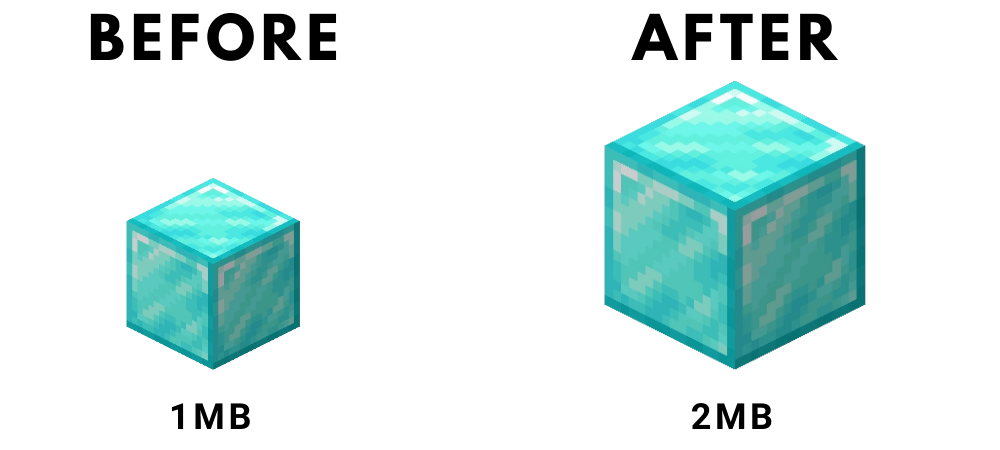

SegWit2x was a movement beyond the SegWit change to improve the Bitcoin blockchain by increasing the size of blocks from 1MB to 2MB (2x). In 2017, users had been paying miners a lot of money to make transactions. Fees were high and users were annoyed.

Bitcoin needed to scale to service more transactions.

SegWit2x was a proposal that would require a hard fork, and it was built on the back of a soft fork proposal.

At it’s heart, SegWit2x was two separate changes to Bitcoin combined into one.

First, you have Segregated Witness or ‘SegWit’ (outlined above).

SegWit was the “small blocker” solution to scaling Bitcoin - instead of increasing the block size, you would instead use the existing block space more efficiently.

Then you had the “big blocker” solution, which is where the ‘2x’ comes from. Their solution was to simply double the size of existing blocks.

And that is where the New York Agreement came into play.

This agreement was initially formed so that the Bitcoin network would prevent splitting into two different coins.

The solution proposed by the agreement runners was to give both parties what they wanted: a doubling of the block size and an activation of SegWit.

In order to implement SegWit2x, there would have to have been a considerable change in the rules of bitcoin governance.

However, the revolutionary aim was that SegWit2x would keep all existing bitcoin users on the same singular blockchain.

In the run-up to its proposed adoption, startups and miners were the most overt supporters of the new update.

Fundamentally, this was based on the frustrations people had over bitcoin adoption. Bitcoin’s slowness allowed other coins to take market share.

The other huge fans of the SegWit2x proposal were larger bitcoin companies like Circle and Coinbase. While they would ultimately suspend their support, their logic was similar to that of miners and startups.

For the most part, these companies make money when there is lots of coin circulation. More transactions equals more fees for them to charge. If users don’t want to send their coins to your exchange because the transaction fees are too high, that is bad for business.

SegWit2X satisfied many of the shared aims of the various stakeholders. It would allow Bitcoin to increase its transaction throughput in the short term and allow exchanges and miners to continue to make money as usual even if it meant potentially harming what made Bitcoin great.

The opposition to SegWit2x came from node operators, developers, and users in developing countries.

Part of the debate came from an inherently different understanding of what matters most about Bitcoin.

For opponents of SegWit2x, decentralization was of prime importance. Doubling the block size would make it harder to run your own node and verify your own transactions and this was doubly true of people in the developing world where running a node was already relatively more expensive.

To opponents of SegWit2x, the hard fork violated the whole point of Bitcoin - to create an open financial system that everyone could afford to participate in.

Ultimately, the risks outweighed any potential benefits. While SegWit2x would increase the speed of transactions, the burden would have been felt more keenly by every day users operating nodes, as they would have had to store more data.

With opposition in both ideology and the rollout of the protocol, there was ultimately too wide a gulf to bridge.

On November 8, 2017, the proposal was suspended due to the ongoing resistance to the protocol. Companies such as Coinbase and Circle revoked their support, and ultimately the protocol failed.

BuyBitcoinWorldWide writers are subject-matter experts and base their articles on firsthand information, like interviews with experts, white papers or original studies and experience. We also use trusted research and studies from other well-known sources. You can learn more about our editorial guidelines.

Disclaimer: Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. Buy Bitcoin Worldwide is for educational purposes only. Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. Buy Bitcoin Worldwide does not promote, facilitate or engage in futures, options contracts or any other form of derivatives trading.

Buy Bitcoin Worldwide does not offer legal advice. Any such advice should be sought independently of visiting Buy Bitcoin Worldwide. Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website.

Buy Bitcoin Worldwide receives compensation with respect to its referrals for out-bound crypto exchanges and crypto wallet websites.

Wallabit Media LLC and/or its owner/writers own Bitcoin.

Registered Address: 530-B Harkle Road Ste 100 Santa Fe, NM 87505