SegWit (Segregated Witness) is the name used for an implemented process change in the way Bitcoin stores the transaction data in the blockchain. The code for this change was released in 2015, and SegWit finally went live in August 2017.

SegWit improves Bitcoin and fixes a number of bugs.

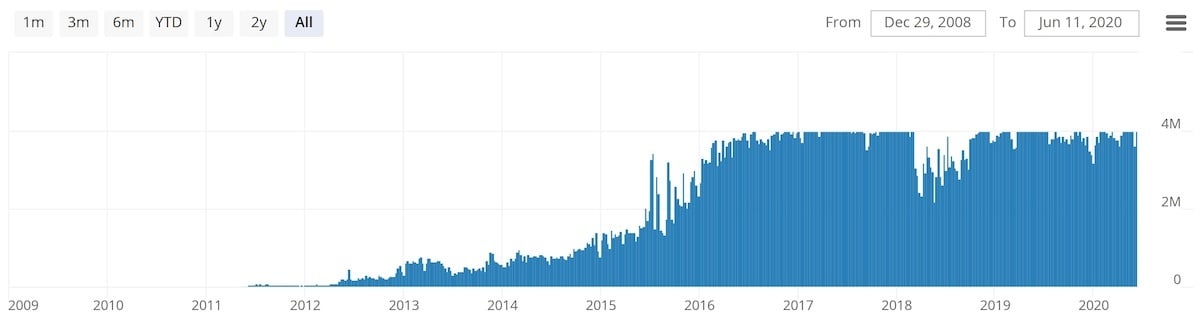

Primarily, SegWit doubled the transaction capacity of the Bitcoin network. While lot of people are claiming that SegWit did not increase the block size, it’s very easy to see that, yes, SegWit was a block size increase!

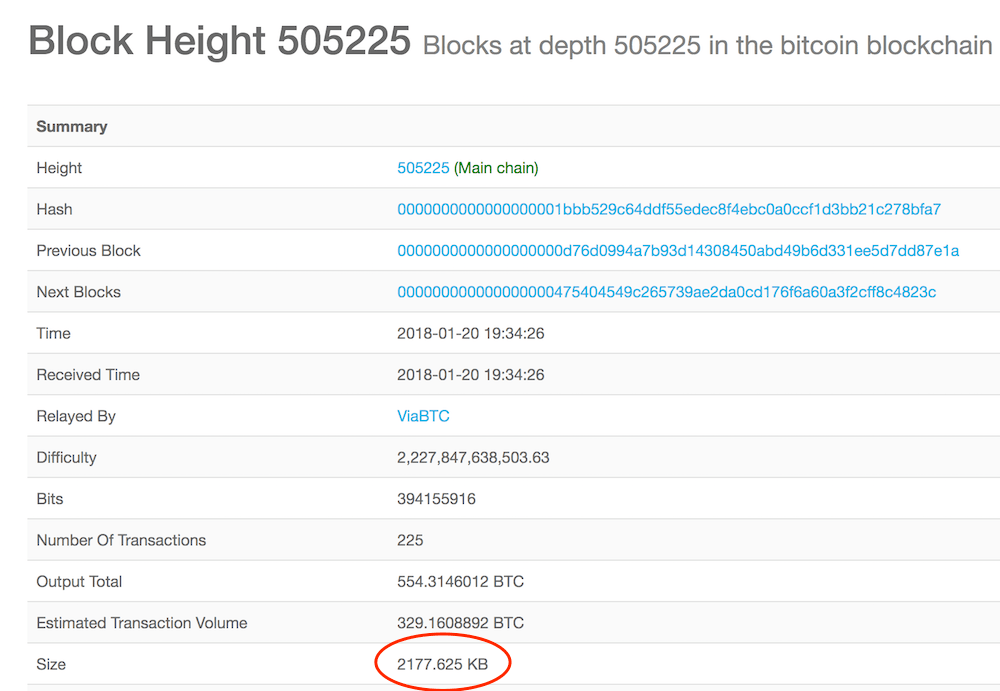

Here, for example, we can see a 2,177 KB (2.17 MB) Bitcoin block mined in January 2018.

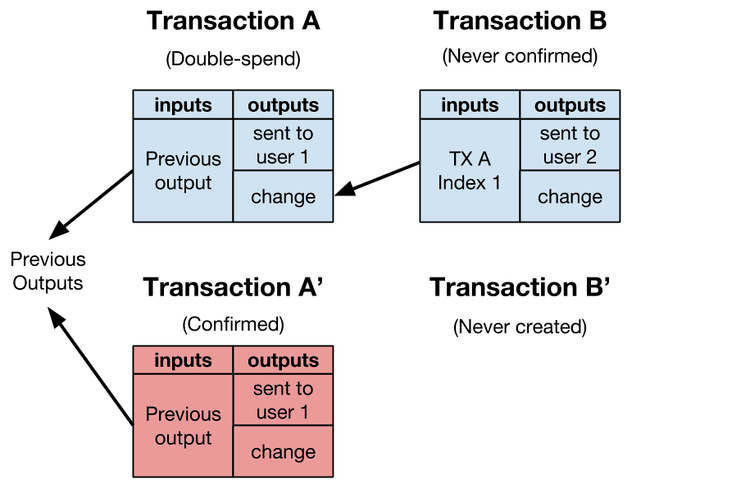

In addition to increasing Bitcoin’s ability to process transactions, SegWit fixed a flaw in Bitcoin’s protocol that allowed nodes to tamper with transaction IDs of transactions on the network. This bug was known as the ‘transaction malleability bug’.

Without going into too much detail on how exactly that bug worked, here is the short version:

If all the right conditions were met, a user could change the transaction ID to a spend before it could be confirmed by the network. This makes it easier to pretend this transaction didn’t happen, which may be useful to someone looking to claim they sent coins to someone else when they really didn’t.

It would be similar to receiving a package from Amazon and claiming you never got it, and using a faked tracking number from FedEx that backs up your story.

That is what transaction malleability allowed you to do.

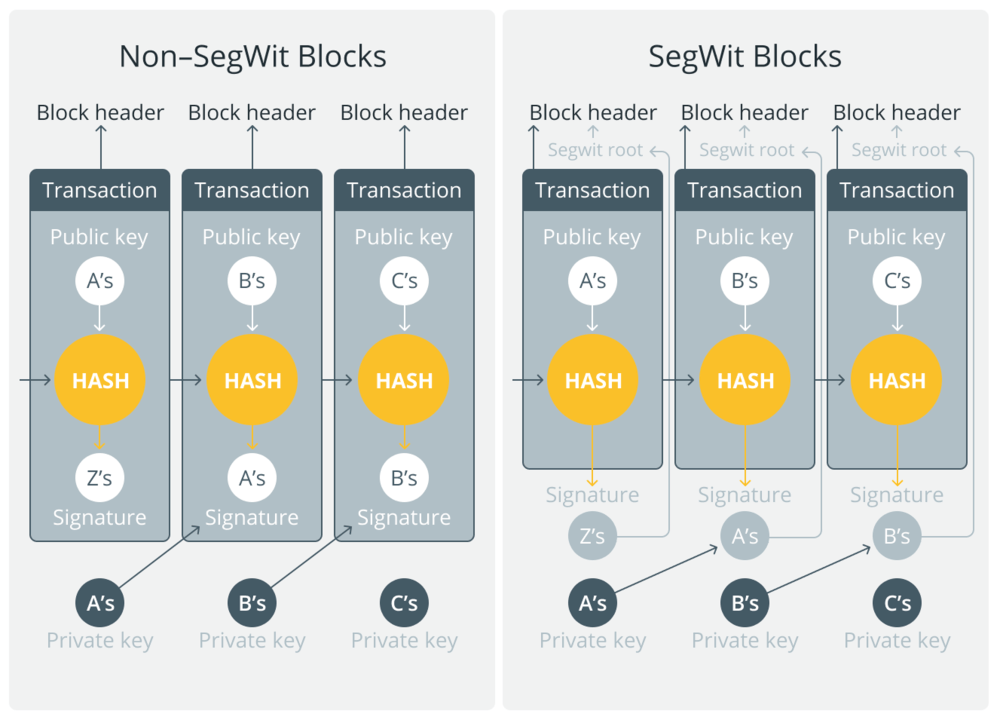

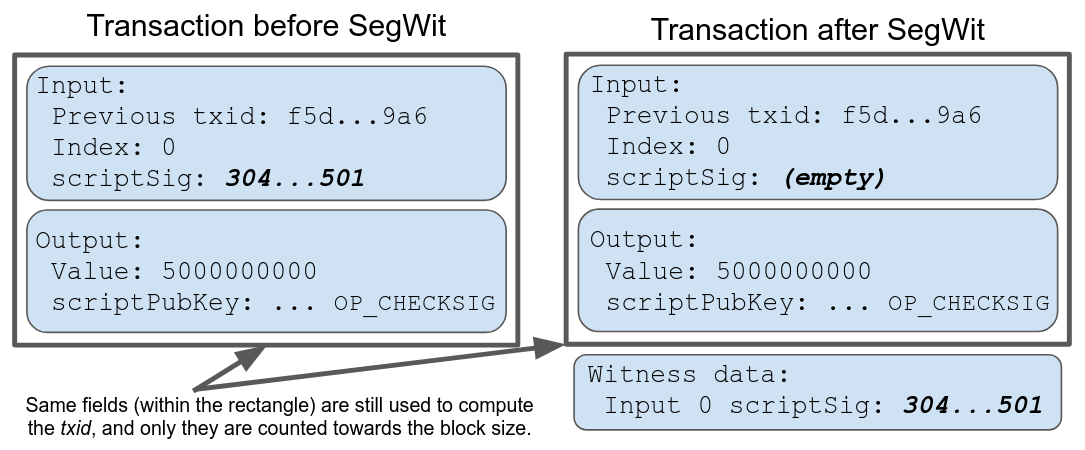

Segwit increased the amount of transactions that could fit into a block and fixed the transaction malleability bug by removing what is known as ‘the witness data’ or ‘signature data’ from the input field of a block.

Transactions get smaller, so you can put more into a block. And with witness data removed, there is no way to change the TXID of a transaction.

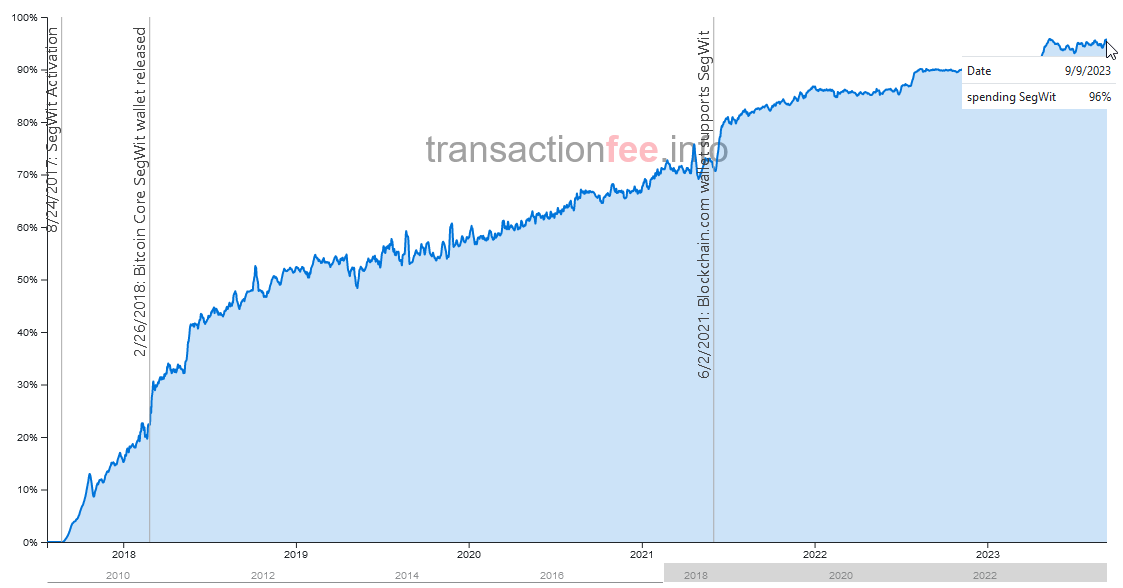

SegWit adoption is increasing. 96% of all Bitcoin transactions use SegWit addresses.

Another sign of the adoption is the support by many of the exchanges and digital hardware wallets allowing accounts that are SegWit accounts. Two of the top digital hardware wallets, Ledger and Trezor both support SegWit accounts, while many of the larger exchanges like Coinbase support, allow legacy and SegWit support.

It is important to understand the differences in managing these accounts on your digital wallets

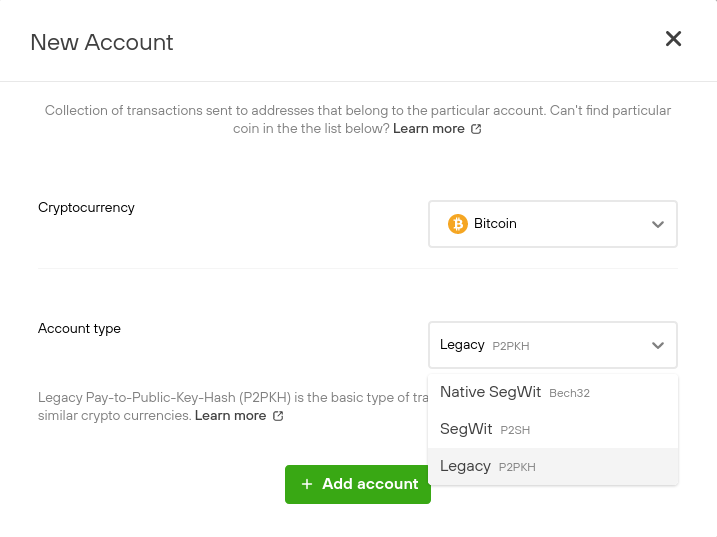

On the Trezor wallet, a “standard” account is a SegWit account. That means that when you set up a Trezor device, it will generate a SegWit Bech32 address by default.

Trezor will continue to support Legacy accounts on their devices, but in order to benefit from the SegWit change you must move your coins into a SegWit account from a legacy account.

You can pick which kind of address you want when you set up your TREZOR device:

In Bitcoin there are multiple address formats that can reside in the blockchain. Most wallets support multiple format types with the most common being P2PKH, P2SH, and Bech32. The format of the SegWit address is the Bech32 format, also known as the bc1 address because the string always starts with ‘bc1’.

Here is an example of what a Bech32 address would look like:

Bech32 is the native Segwit address format, and is supported by the majority of software and hardware wallets.

Lightening Network is a fix to both the speed and cost of a Bitcoin transaction and is a decentralized network that allows the transfer of bitcoin ownership by way of an additional layer in a transaction. SegWit is the foundation for the Lightning Network. By eliminating the possibility for transaction malleability, secure payment channels can be created that will eventually allow the Bitcoin network to process millions of transactions per second. Lastly, SegWit is a way to help Bitcoin scale to accommodate its ever-expanding user base, without forcing a hard-fork.

Before SegWit, the Transaction ID of a transaction could have been changed by manipulating the unlocking code of the transaction (your digital signature). After you digitally sign a transaction, it is sent through Bitcoin’s cryptographic hash function which results in a unique transaction ID.

If one character is changed in the digital signature, it will result in an entirely different transaction ID. SegWit moves the signature to the end of the transaction data, so the Transaction ID is created from everything but the digital signature.

In effect, this change renders it impossible to change the Transaction ID – if malicious nodes were able to tamper with Transaction IDs, the Lightning Network wouldn’t be possible.

SegWit is short for 'segregated witness'.

SegWit was a soft fork. This is opposed to a hard fork which would create a separate coin (such as Bitcoin Cash). It added features and fixes to Bitcoin in 2017.

Yes, hardware wallets like Ledger and TREZOR support SegWit.

SegWit was developed by Peter Wuille. He's one of Bitcoin's most prolific developers, and won Coindesk's 2017 Most Influential Award.

Yes, congrats Litecoin! :) Litecoin will also be adding more features in the future.

You can think of the Bitcoin (bitcoin is modeled after gold) network like a chain, and each link in the chain is a block. For the sake of simplicity, let’s picture a block that only contains one transaction. If Mike sends 1 BTC to Bob, he’d add important data to the block:

Mike’s public key and digital signature must be included in the block to prove that the transaction is legitimate and really did come from him. The digital signature is included in the block as script (you can think of script as code). Just like people sign checks to authorize them, users of the BTC network must sign transactions to authorize them.

Despite being necessary to authenticate transactions, digital signatures fill up a lot of space that could otherwise be used for transaction data.

When thousands of transactions are initiated at once, there is not enough room for all of them to enter the same block at the same height. Users must pay a transaction fee which incentivizes miners to include their transaction in the block before others’. The more you pay, the faster your transaction will go through.

Unfortunately, transaction fees can get quite pricey. In December of 2017, it wasn’t unheard of to pay $50 per transaction if you wanted it to be validated within 10-20 minutes. Bitcoin’s scalability issue is one of its most significant obstacles prior to mainstream adoption. Nobody in today’s society wants to pay $20 for a cup of coffee while waiting around for their payment to clear.

Something must change.

Some believe the best way to solve the problem is expanding Bitcoin’s block size – however, that solution would require Bitcoin to hard fork. Rather than forking into a completely new cryptocurrency, SegWit has been implemented to significantly increase Bitcoin’s ability to process transactions.

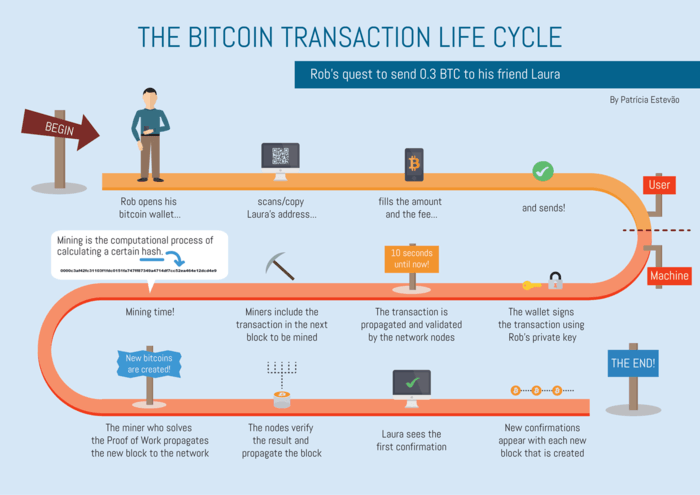

For an easy primer on the lifecycle of a standard Bitcoin transaction, you can reference the image below from the Bitcoin wiki.

SegWit was activated via UASF. As mentioned previously, every block is composed of transaction data (public key, amount of BTC, etc.) and script (the sender’s public key and their digital signature). Although it is imperative that digital signatures are included in the validation process, they use a lot of space in blocks that could otherwise be used for more transactions.

Digital signatures, also known as witnesses, take up 60% of transaction data and usually the witness data exists in the middle of the transaction data. Segregated Witness is a way to remove the witness (signature) from the transaction – instead, SegWit transactions move the witness data to the end of the transaction. When a SegWit transaction is being validated by a Legacy node (one that hasn’t upgraded), the witness data is stripped from the transaction. By removing signatures from the main block of transactions, transaction size is notably smaller, thus allowing far more transactions per block.

It is important to note that prior to SegWit, Bitcoin’s maximum block size was 1,000,000 bytes (1MB) – that is, once that data limit was reached, the block was no longer able to accept more transactions and any other transactions that weren’t included in the block had to wait in the mempool.

SegWit, contrary to popular belief, is indeed a block size increase. SegWit has implemented a new way to measure the size of transactions. Instead of relying on a 1,000,000-byte block size, SegWit measures blocks using something known as block weight.

Here’s the formula used to calculate block weight:

(tx size with witness data stripped) * 3 + (tx size)

Since Segwit transactions are broadcasted to all nodes with the witness data stripped, the legacy nodes will never have to validate a block greater than 1,000,000 bytes, therefore adhering to Bitcoin’s original protocol.

Conversely, SegWit nodes can receive blocks that are very close to, but not quite 4MB in size. In order for a block to be (near) 4MB, it would have to consist of primarily witness data rather than transaction data. It would be incredibly close to 4MB with the witness data, but still, less than 1,000,000 bytes when stripped of the witness data.

Although SegWit nodes are capable of validating a 4MB (4,000,000 bytes) block, in practice, that block size is ridiculously large. In most cases, a SegWit block will not exceed 2MB.

| Before | After | |

|---|---|---|

| Max Block Size | 1 MB | 4 MB |

| Transactions per Second | 3 TX/s | 7 TX/s |

| Transaction Malleability Bug | Broken | Fixed |

Part of the issue with SegWit2x was that it required a hard fork, as opposed to vanilla SegWit, which would only require a soft fork.

A soft fork is, at its core, backwards compatible. It allows for a shift in network rules and creates blocks that will still be recognized by existing, non-upgraded software.

On the other hand, a hard fork involves taking a blockchain and splitting it into two permanently. It performs a complete overhaul of the rules that apply to the blockchain and completely redesigns it so that it will not recognize old software.

In some cases, a hard fork can split a network into two, creating different systems that allow people to choose which they wish to adopt. This was seen in the case of bitcoin and bitcoin cash.

However, a split can also be caused if enough people adopt both possible outcomes, causing disruption to networks and systems.

BuyBitcoinWorldWide writers are subject-matter experts and base their articles on firsthand information, like interviews with experts, white papers or original studies and experience. We also use trusted research and studies from other well-known sources. You can learn more about our editorial guidelines.