We’re going to show you exactly how to import crypto into TurboTax or QuickBooks.

We’ve posted bitcoin and crypto tax software, and now we’re going to focus on the next step of the process:

Getting that data into Turbotax.

First, you need crypto tax software.

Crypto tax software will pull all of your crypto trades, buys, sells, income, DeFi income, NFT sales, and any other type of crypto into one report.

Once you have imported your trade history, the crypto tax software will compile this and give you a rundown of total capital gains or losses.

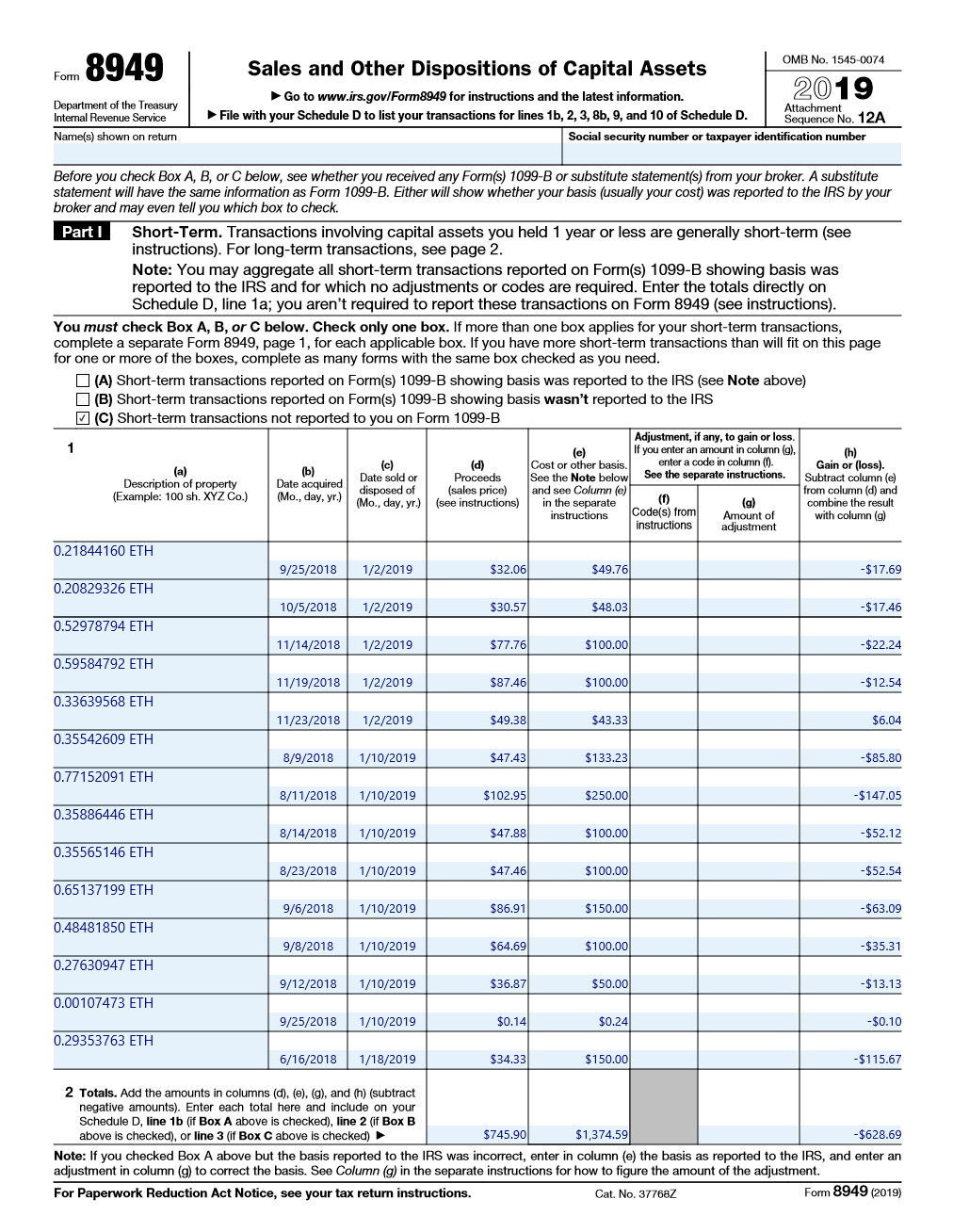

You can now export your data. IRS Form 8949 (Sales and Other Dispositions of Capital Assets) is the most common way to do this, and it’s always a good idea to keep a copy for your records. You can also export directly to TurboTax’s proprietary online format.

Filing your cryptocurrency capital gains/losses with TurboTax is simple. For this tutorial, we’ll be using the online platform.

To file investment gains and/or losses, you’ll need TurboTax Premier or Self-Employed.

When filling out your financial picture, be sure to select I sold or traded cryptocurrency.

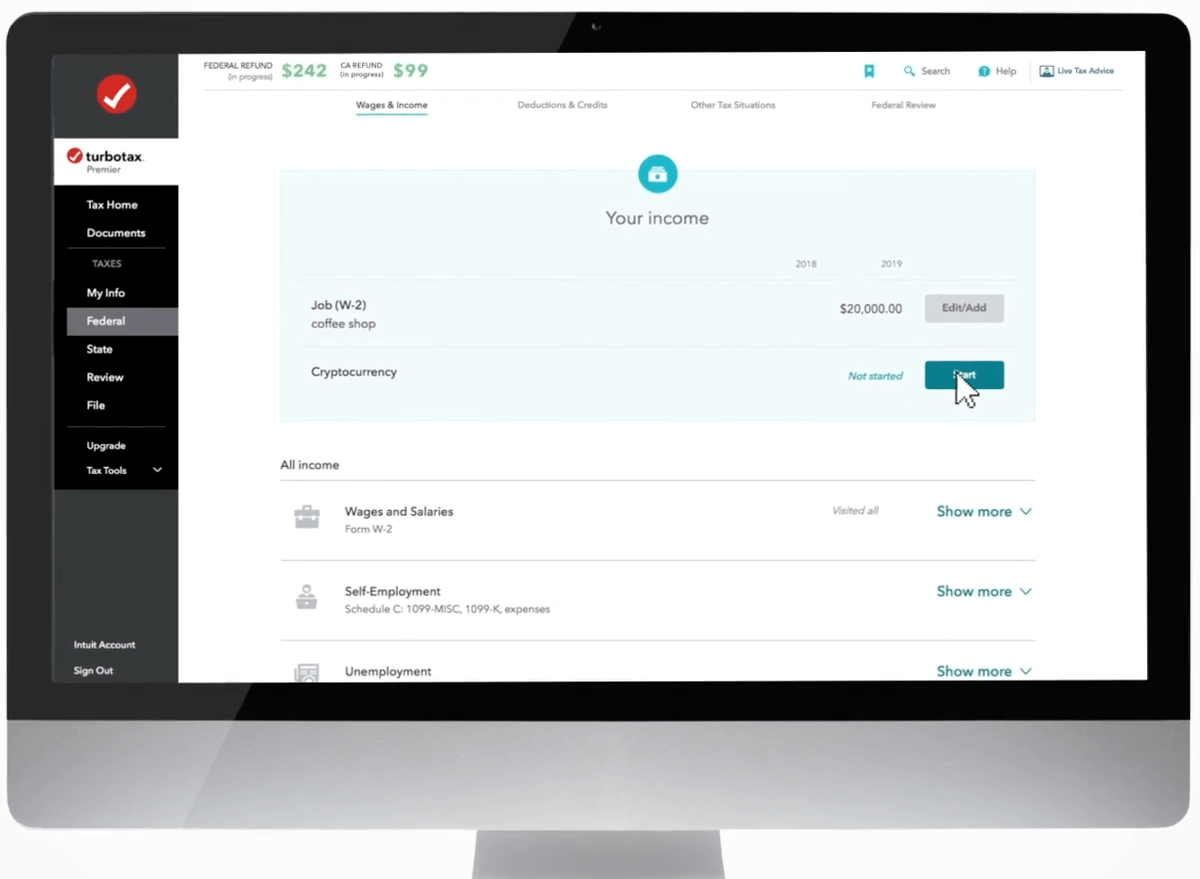

Once you have begun your return and filled out the initial prompts, navigate to the Cryptocurrency tab by choosing Federal > Wages & Income > Cryptocurrency

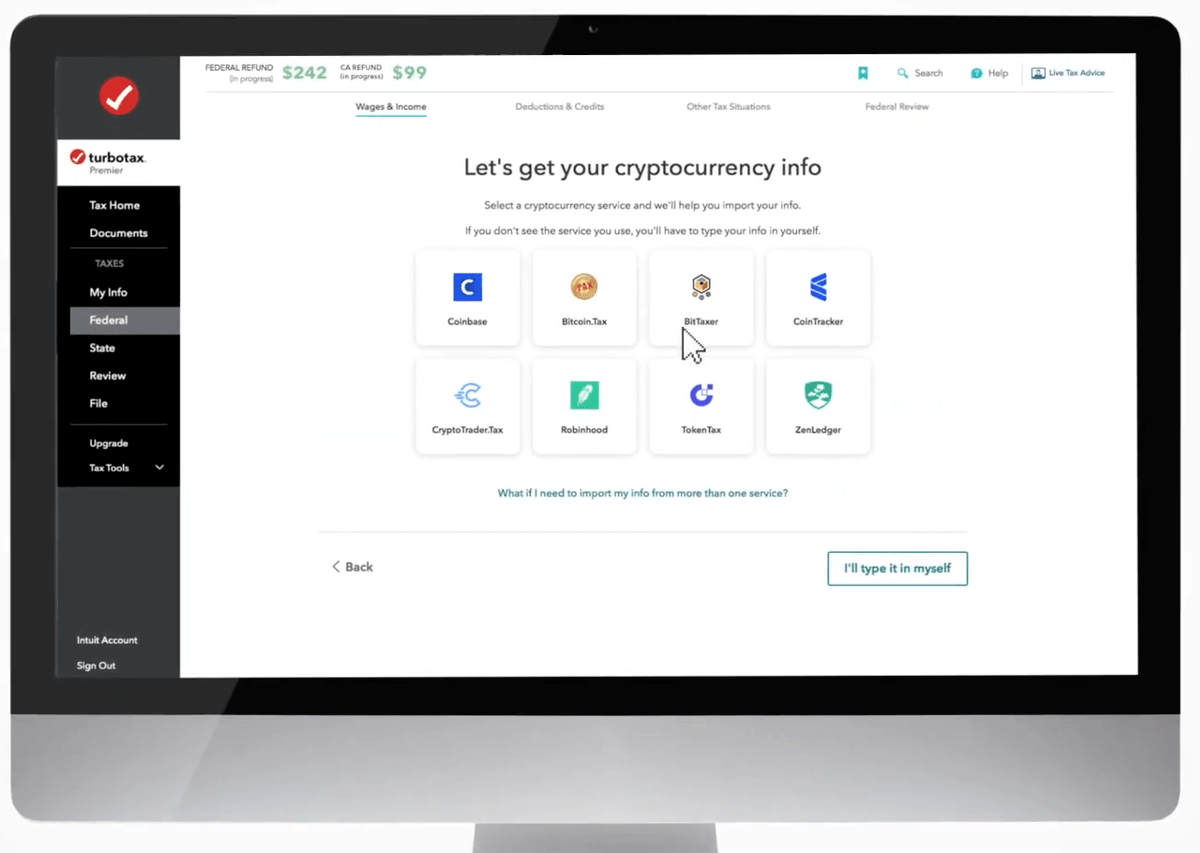

Here, you can link the third-party service you used to prepare your trade history or choose to enter information manually.

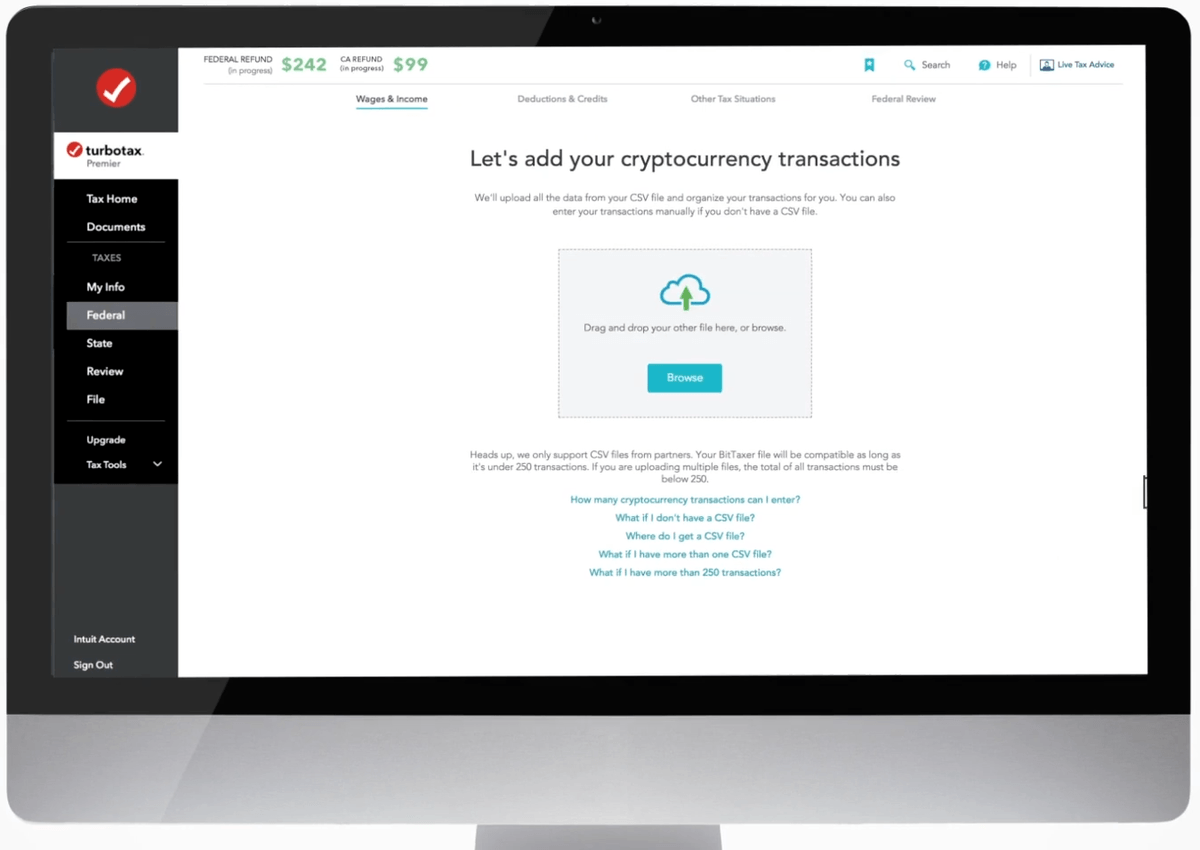

Upload the .csv file that you prepared earlier.

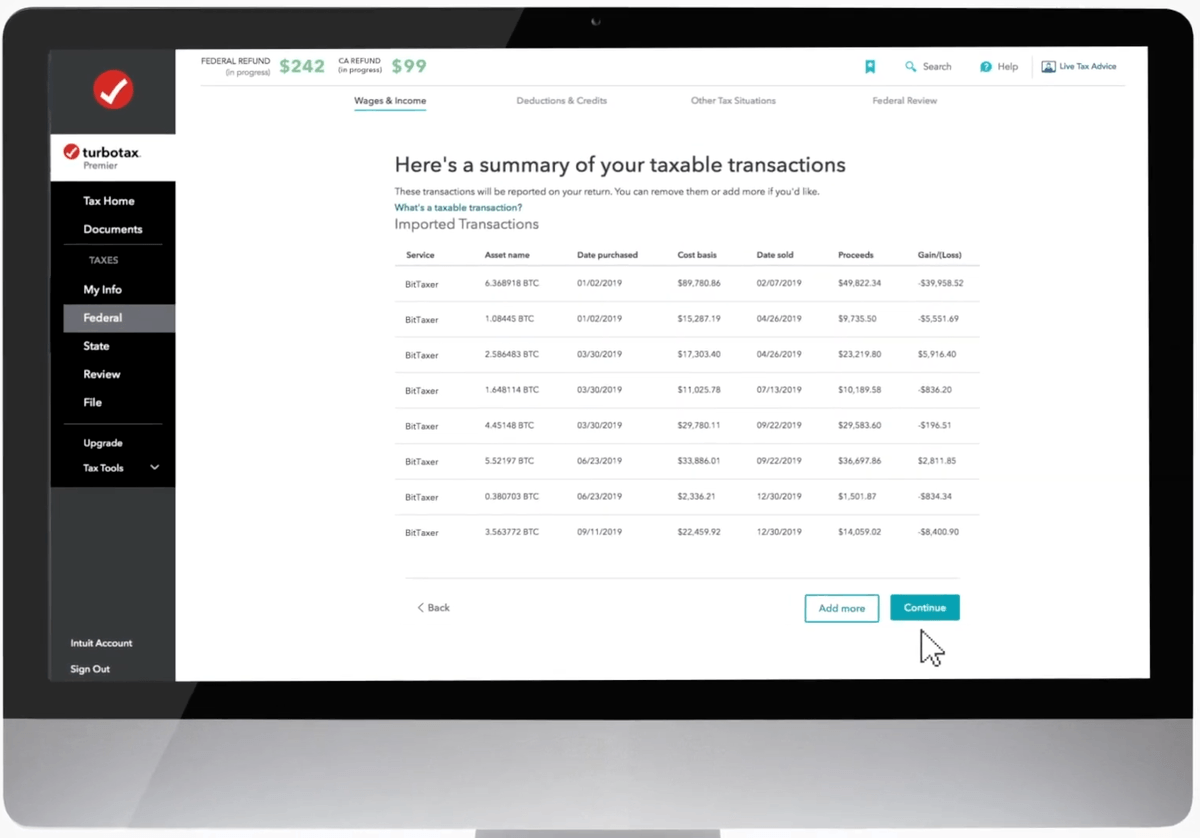

Check the summary of your taxable transactions to ensure that everything looks right.

That’s it! You’ve successfully imported your cryptocurrency transactions into TurboTax and can rest assured that your capital gains and/or losses will be accurately reported.

Make sure to check out these other crypto tax services as well to find the right one for you!

Crypto tax software makes it easy to properly file taxes on your cryptocurrency trading and protects you in the case of an audit.

| Software |

|---|

| Koinly |

| CoinLedger |

| Accointing |

| Bitcoin.Tax |

| CoinTracking |

| TaxBit |

| Cointracker |

| TokenTax |

| ZenLedger |

| CoinPanda |

For the TurboTax desktop app, you will need to use TXT format instead of CSV format.

TurboTax does allow importing from Coinbase. However, an important note:

Since crypto is taxed on all your trades, importing just from Coinbase may be inaccurate, causing you to pay more.

It’s best to use crypto tax software to get all your trades and then import them into TurboTax.

If you only used Coinbase and never sent crypto off or into Coinbase, then you don’t need crypto tax software.

Mining income is likely taxed as normal income. TurboTax will allow you to add this income manually or through importing from crypto tax software.

Cryptocurrencies such as Bitcoin and Ethereum are classified as property under federal law. This means that the same tax obligations apply to crypto as do to physical property such as real estate. The main implication of this is that most cryptocurrency transactions are subject to capital gains tax.

The following are considered taxable events:

The following are not considered taxable events:

Proceeds of crypto mining are generally treated as income and taxed as such.

When a taxable event occurs, capital gains or losses are calculated by subtracting the purchase price (also known as the cost-basis) from the selling price.

For example:

If you bought one Bitcoin for $5,000 USD in 2018 and sold it for $10,000 USD in 2020, you would realize a capital gain of $5k, or 100%.

This capital gain would be subject to taxation at the long-term capital gains tax rate, as you held it for more than one year. This rate varies between 0% and 20%, depending on your taxable income and filing status.

Capital gains realized less than one year after purchase are added to your income and taxed at the applicable rate.

To accurately calculate the capital gains tax due on every transaction, you would need to have records of the purchase price of Asset A in USD, the conversion rate of Asset A to Asset B, the value of Asset B at the time of exchange in USD, and the amount of Asset B purchased.

These data are logged by your exchange, but sifting through them manually is a painstaking task. Let’s take a look at how to do it using crypto tax software.

BuyBitcoinWorldWide writers are subject-matter experts and base their articles on firsthand information, like interviews with experts, white papers or original studies and experience. We also use trusted research and studies from other well-known sources. You can learn more about our editorial guidelines.