Stablecoins are cryptocurrencies that are backed by government currencies, like the US dollar or euro.

As cryptocurrency began to grow, there was a demand for coins that were pegged to real-world assets like the US dollar.

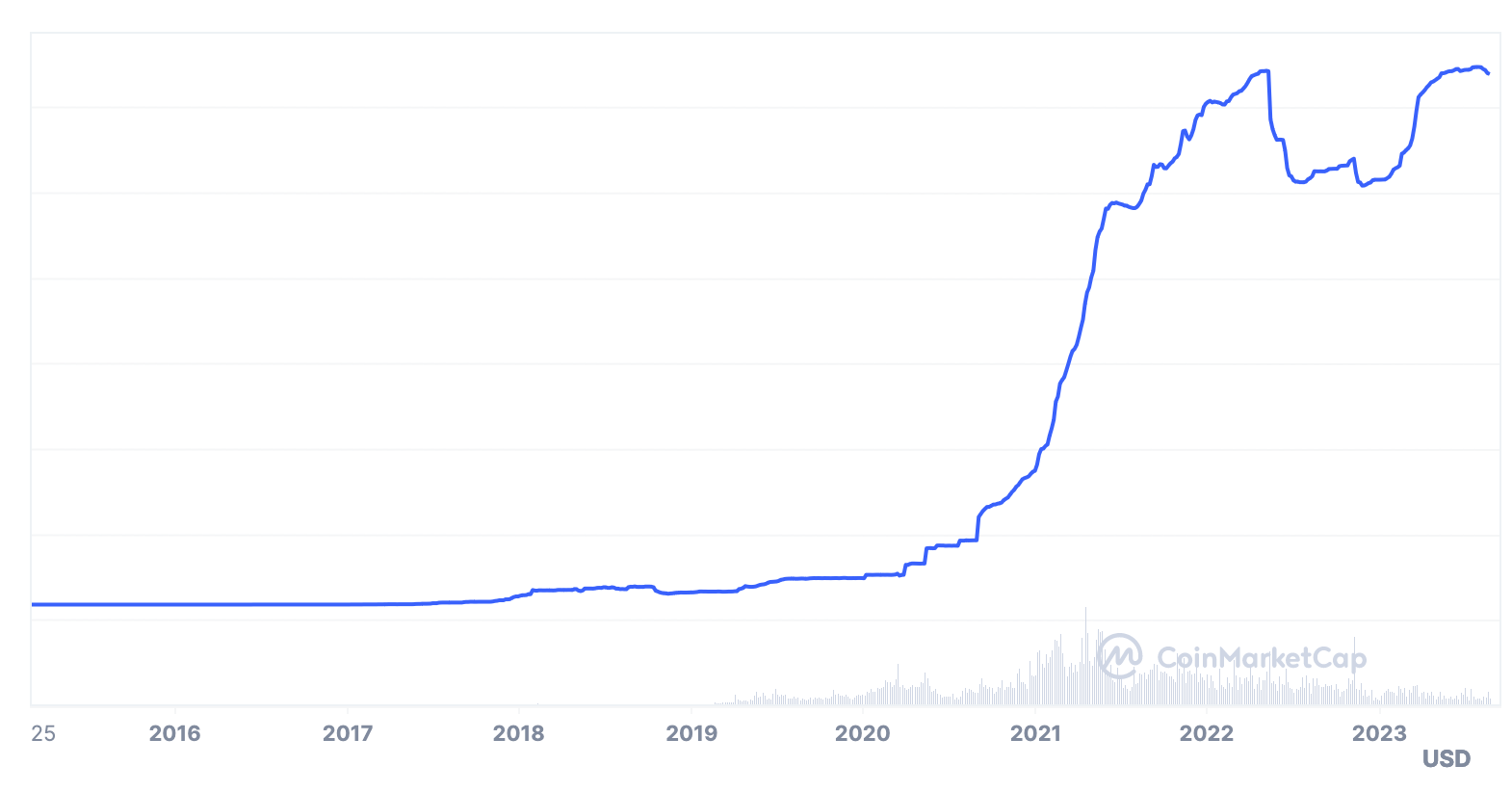

Tether (USDT) was the first stable coin to launch in 2015.

Tether created a coin called Tether, and each unit of Tether was backed and equal to $1 US dollar.

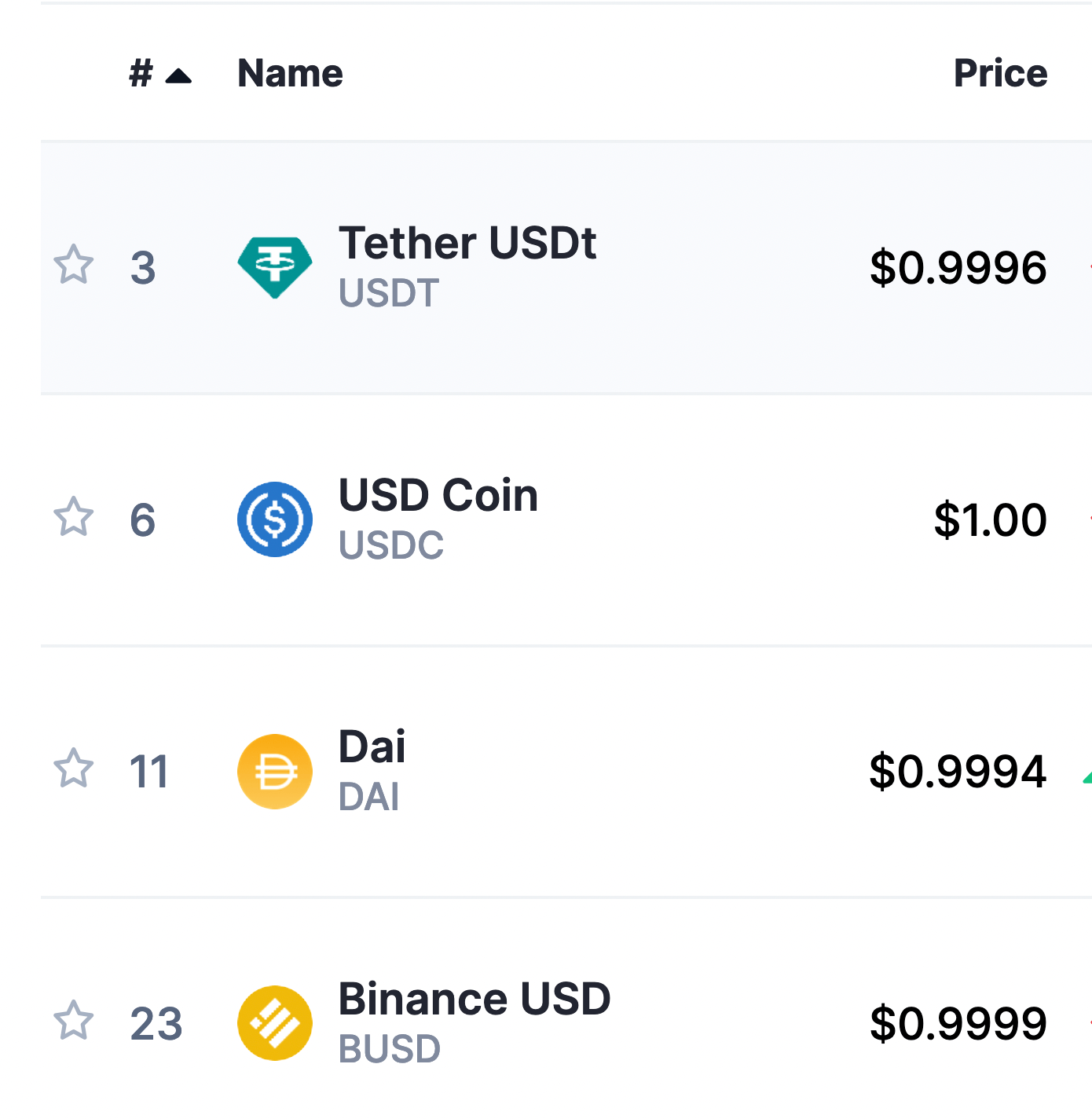

Today, there are other large stable coins pegged to the US dollar, namely USDC, which is run by Circle.

BUSD, is another large stablecoin, which is operated by Binance.

There are other stable coins backing other assets, but none of them are similar in size to the top three USD stable coins: USDT, USDC and BUSD.

The pros of stable coins are:

The main issue with stable coins is that you need to trust the issuer that they actually hold the assets backing the stablecoin.

For example, it’s technically possible that the company running USDT doesn’t own any dollars.

However, the markets are quick to react with news.

When there are scares about stable coin issuers owning backing assets, the peg of the coin usually comes undone.

The risks of stable coins are larger when using them for long term storage. If you’re just transferring or sending money quickly, the risks are fairly low since the peg would need to come undone exactly at the time of transfer.

BuyBitcoinWorldWide writers are subject-matter experts and base their articles on firsthand information, like interviews with experts, white papers or original studies and experience. We also use trusted research and studies from other well-known sources. You can learn more about our editorial guidelines.

Disclaimer: Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. Buy Bitcoin Worldwide is for educational purposes only. Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. Buy Bitcoin Worldwide does not promote, facilitate or engage in futures, options contracts or any other form of derivatives trading.

Buy Bitcoin Worldwide does not offer legal advice. Any such advice should be sought independently of visiting Buy Bitcoin Worldwide. Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website.

Buy Bitcoin Worldwide receives compensation with respect to its referrals for out-bound crypto exchanges and crypto wallet websites.

Wallabit Media LLC and/or its owner/writers own Bitcoin.

Registered Address: 530-B Harkle Road Ste 100 Santa Fe, NM 87505