Latest 30-Day Estimate

Loading...

Latest 60-Day Estimate

Loading...

Bitcoin Volatility Time Series Charts

Loading chart... (uses JavaScript)

Bitcoin Price and Volatility

Loading chart... (uses JavaScript)

Frequently Asked Questions

What is The Bitcoin Volatility Index?

This site tracks the volatility of the Bitcoin price in US dollars.

Is there a Bitcoin volatility index?

Yes, there is a Bitcoin volatility index.

What is Bitcoin's historical volatility?

See the charts below to find Bitcoin's historical volatility.

| Year | Average 30-Day BTC/USD Volatility |

| 2010 | 6.21% |

| 2011 | 8.26% |

| 2012 | 4.50% |

| 2013 | 5.50% |

| 2014 | 5.06% |

| 2015 | 4.26% |

| 2016 | 2.49% |

| 2017 | 4.13% |

| 2018 | 4.58% |

| 2019 | 4.06% |

| 2020 | 5.17% |

| 2021 | 4.56% |

Is there a VIX for crypto?

Yes, there is a volatility index (VIX) for cryptocurrency. The crypto volatility index (CVI) is a decentralized VIX for cryptocurrency that allows users to restrict themselves against market volatility, as well as impermanent loss. This site has several crypto volatility trackers with up-to-date data.

Is Bitcoin volatile?

Yes, Bitcoin is considered fairly volatile. However, it really depends on what cryptocurrencies you compare it to.

The volatility of Bitcoin is measured by how much Bitcoin's price fluctuates, relative to the average price in a period of time.

What is Bitcoin daily volatility?

Bitcoin's daily volatility = Bitcoin's standard deviation = √(∑(Bitcoin's opening price – Price at N)^2 /N). You can use the following formula for a general timeframe volatility calculation: √timeframe * √Bitcoin's price variance.

Why is the price of Bitcoin volatile?

The cryptocurrency industry thrives on performs based on speculation. Crypto investors make bets that Bitcoin's price will go up or go down to make profits. This causes a sudden increase or decrease of Bitcoin's price, which leads to volatility.

What is volatility?

Volatility is a measure of how much the price of a financial asset varies over time.

Why is volatility important?

Volatility means that an asset is risky to hold—on any given day, its value may go up or down substantially. The more volatile an asset, the more people will want to limit their exposure to it, either by simply not holding it or by hedging.

Volatility also increases the cost of hedging, which is a major contributor to the price of merchant services. If Bitcoin volatility decreases, the cost of converting into and out of Bitcoin will decrease as well.

What definition of volatility does The Bitcoin Volatility Index use?

The standard deviation of daily returns for the preceding 30- and 60-day windows. These are measures of historical volatility(1) based on past Bitcoin prices. When the Bitcoin options market matures, it will be possible to calculate Bitcoin's implied volatility(2), which is in many ways a better measure.

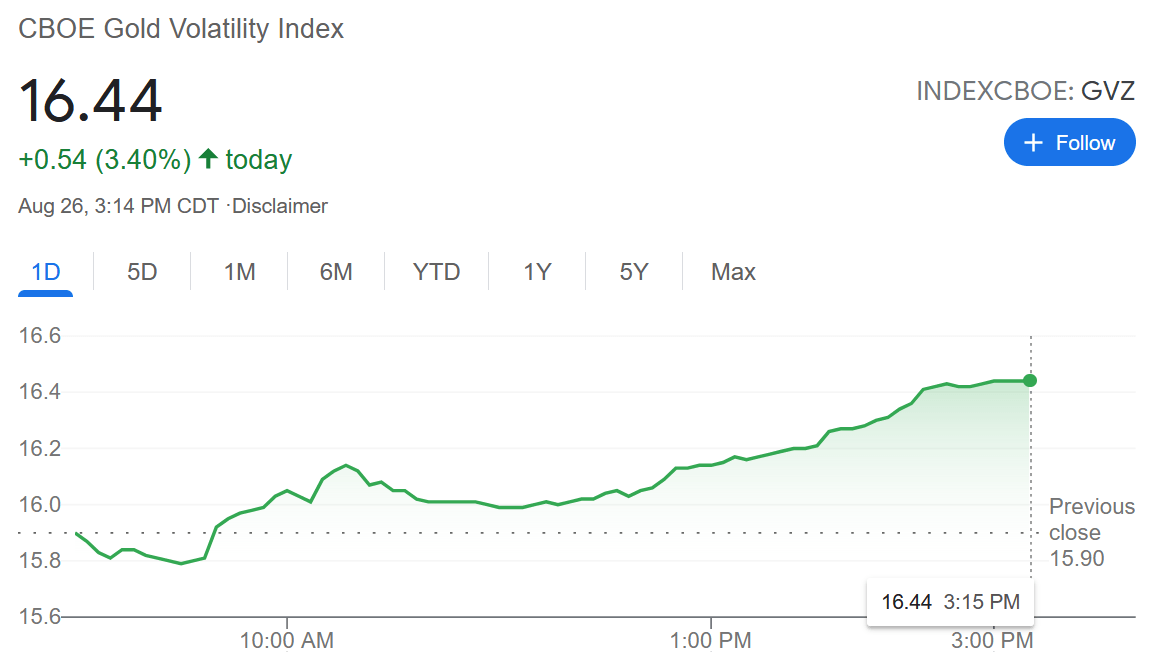

How volatile is Bitcoin relative to gold and other currencies?

For comparison, the volatility of gold averages around 1.2%, while other major currencies average between 0.5% and 1.0%(3).

The chart above shows the volatility of gold and several other currencies against the US Dollar. Series marked with an asterisk are not directly comparable to series not so marked because fiat currency markets are closed on weekends and holidays, and therefore some price changes reflect multiple-day changes.

Such multi-day changes in price are excluded from analysis, and therefore, the 30- and 60-day metrics for these series use fewer than 30 and 60 data points. They are presented for entertainment purposes only.

What is the pricing source?

The Bitcoin Volatility Index is powered by CoinDesk for Bitcoin prices, and by FRED®(4) for other series pricing data.

BuyBitcoinWorldWide writers are subject-matter experts and base their articles on firsthand information, like interviews with experts, white papers or original studies and experience. We also use trusted research and studies from other well-known sources. You can learn more about our editorial guidelines.

- Wikipedia - Volatility, https://en.wikipedia.org/wiki/Volatility_(finance)#Volatility_terminology

- Wikipedia - Implied volatility, https://en.wikipedia.org/wiki/Implied_volatility

- Federal Reserve Bank of St. Louis - CBOE Gold ETF Volatility Index, https://fred.stlouisfed.org/series/GVZCLS

- Federal Reserve Bank of St. Louis - Homepage, https://fred.stlouisfed.org/

- Stock to Flow - Homepage, https://stocktoflow.com/