We may receive advertising compensation when you click certain products. Before jumping into this page, an important disclosure.

This review is based on my use of Coinbase. I have been a Coinbase user since 2016.

What is Coinbase?

Coinbase is a cryptocurrency exchange based in the USA.

It lets you buy, sell, and store crypto.

Is Coinbase Safe?

Unlike other exchanges–Mt Gox & Bitfinex being some prime examples–Coinbase has never lost customer funds in any way.

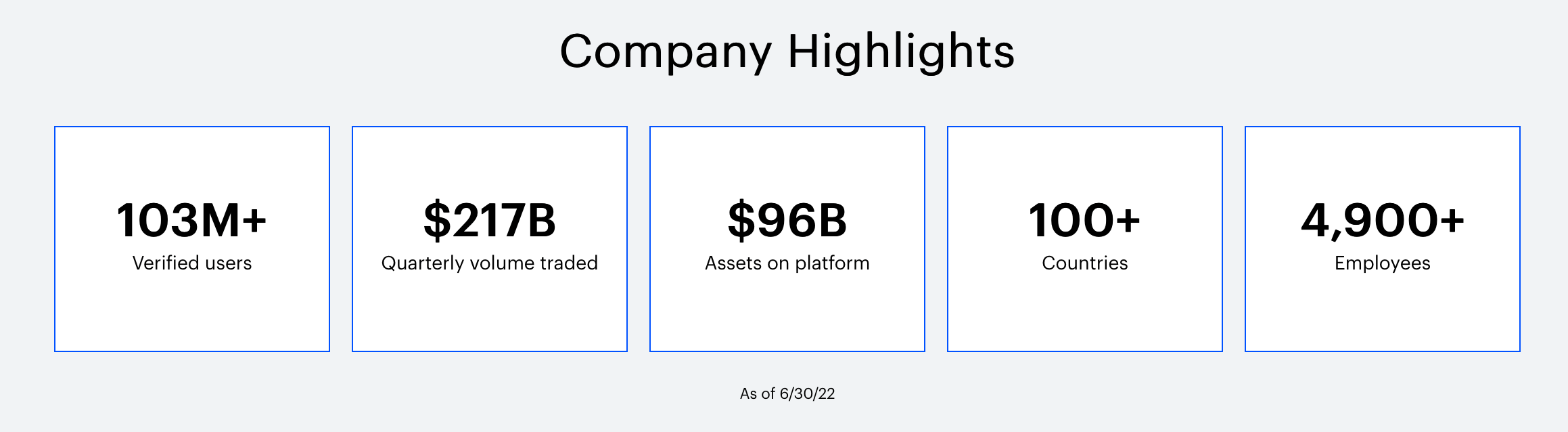

Coinbase is trusted by more than 98 million users across the globe and has been around since 2012.

Key Takeaways

Key Takeaways

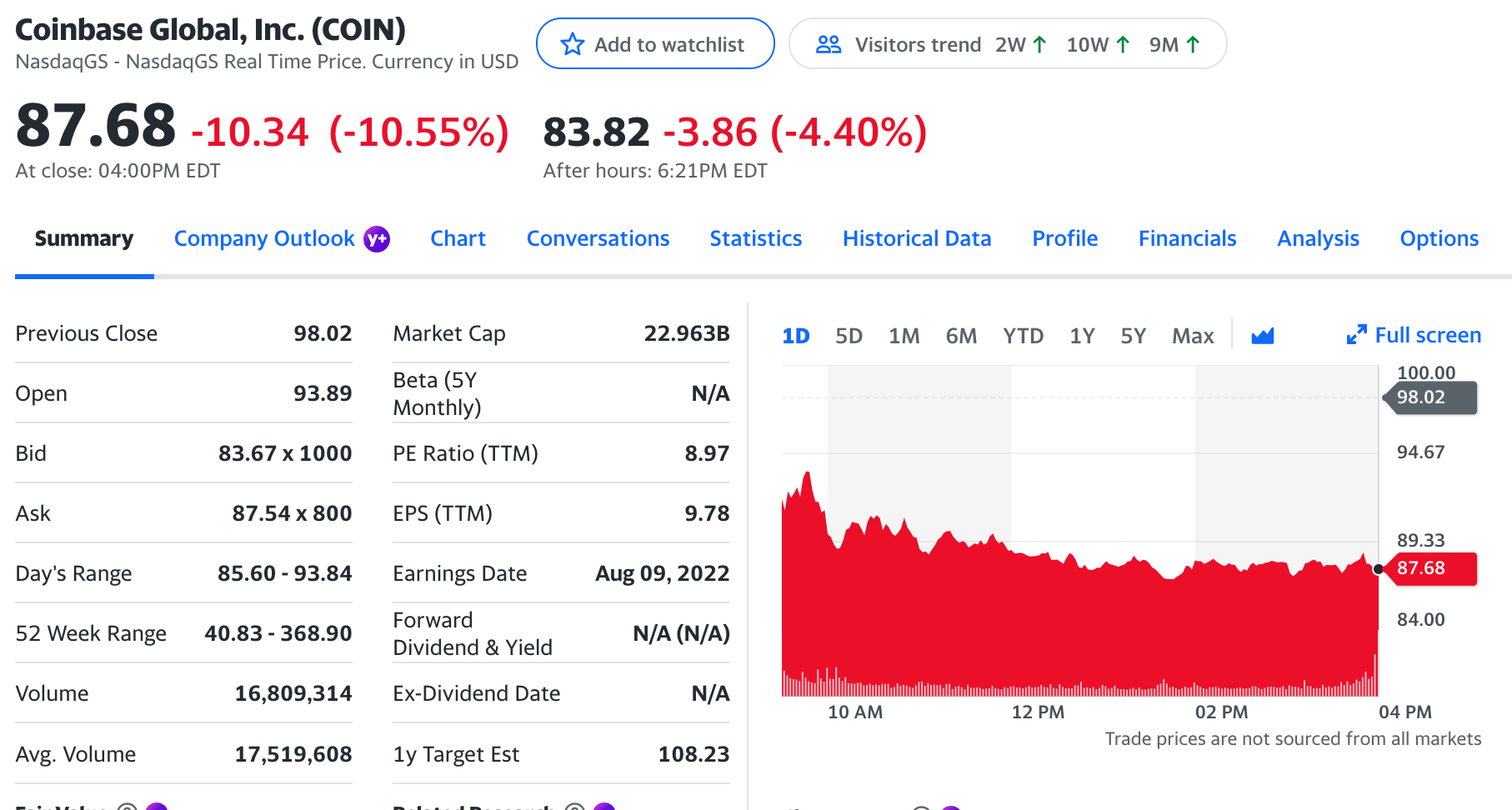

- Coinbase is legit: it's a publicly traded company on the NASDAQ under the ticker COIN.

- Coinbase is safe: the exchange is trusted by more than 98 million users & has been around since 2012.

- Coinbase lets you buy, sell & store crypto--it stores more than $96 billion USD worth of assets on its platform.

Is Coinbase Legit?

Because of how famous Coinbase is, many wonder if Coinbase is a safe place to buy, sell, and store crypto.

Coinbase is legit:

It’s a publicly traded company on the NASDAQ under the ticker COIN(1).

Its stock price can be checked on all major finance sites:

The company stores more than $96 billion USD on its platform and has over 4,000 employees. It’s headquartered in San Francisco.

Fees Charged by Coinbase for Bank Transactions(2)

| Transaction Amount | Coinbase Fee |

|---|---|

| $10 or less | $0.99 |

| More than $10, and less than or equal to $25 | $1.49 |

| More than $25, and less than or equal to $50 | $1.99 |

| More than $50, and less than or equal to $200 | $2.99 |

➤ MORE: Coinbase Fee Calculator

Coinbase Fees by Payment Method

| Payment Method | Fee |

|---|---|

| US bank account | 1.49% |

| Coinbase USD wallet | 1.49% |

| Debit card | 3.99% |

| Instant card withdrawal | Up to 1.50% of any transaction, with a $0.55 minimum fee |

Coinbase Wallet

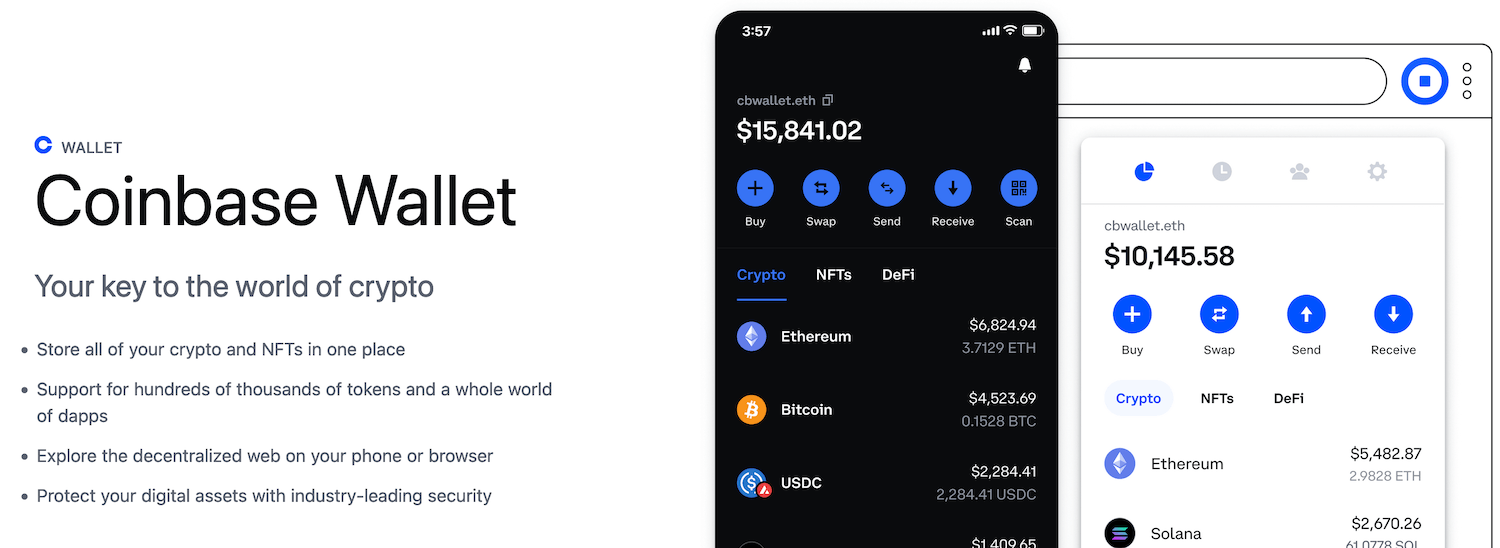

Coinbase Wallet is a crypto wallet developed by Coinbase.

You do not need a Coinbase account to use the Coinbase wallet.

➤ MORE: Crazy Coinbase Statistics

Coinbase wallet lets you store Bitcoin, Ethereum, NFTs, and other digital assets – all for free.

Supported Countries

Coinbase offers its brokerage services in the United States, United Kingdom, Canada, and Singapore.

Coinbase also supports the following European countries:

Andorra, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Gibraltar, Greece, Guernsey, Hungary, Iceland, Ireland, Isle of Man, Italy, Jersey, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, Netherlands, Norway, Poland, Portugal, Romania, San Marino, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, and United Kingdom.

In North America, Coinbase supports Canada, the USA, and Mexico.

In South America, Coinbase only supports customers in Chile via debit card payment.

Coinbase Limits

Coinbase offers very high limits.

Limits depend on your account level, which is determined by how much information you have verified. Fully verified U.S. customers may buy up to $50,000 worth of bitcoin daily.

| Method | Limits | Time Before Withdraw is Allowed |

|---|---|---|

| Debit Card | Up to $7,500/week | Instant once debit clears |

| ACH Transfer | $25k/day (cumulative ACH limit) | Majority of customers can withdraw within 5 business days |

| Wire Transfer | Unlimited | Instant once the wire clears |

European customers may have a maximum of 30,000 euros in their account at any time.

Is Coinbase Going Bankrupt?

Out of nowhere, many speculated that Coinbase may be having bankruptcy issues.

However, its founder came out and said the company was not at risk for bankruptcy(3).

Coinbase Card

Coinbase offers a Visa debit card that is backed by your Coinbase account.

This means you can store your money in crypto, but spend at any store that accepts Visa cards. Additionally, you can get cash back in bitcoin, ETH, and many other coins.

The Coinbase Card is available to all residents in the USA besides Hawaii.

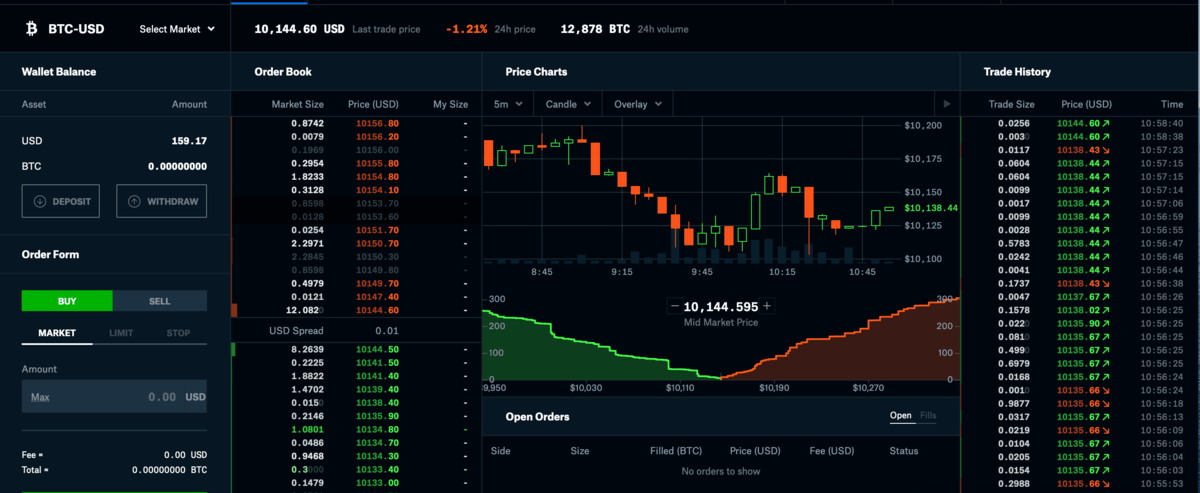

What is Coinbase Pro?

Buying Bitcoin for the first time can be confusing – that’s why Coinbase was created. It’s a simple platform, designed for ease of use and simplicity. Most people will use Coinbase when they buy for the first time. Unfortunately, they charge a fee for that convenience.

Coinbase charges 1.49% on all transactions made with a bank account, and 3.99% for debit/credit cards – these expenses will add up quickly, especially if you are trading often.

The Global Digital Asset Exchange, more commonly known as Coinbase Pro, is one of the most popular cryptocurrency exchange platforms. Coinbase also owns Coinbase Pro, but it is not meant for beginners.

Coinbase Pro is a superb alternative for more experienced crypto traders. Transactions are instant once cash has been deposited.

Drawbacks and Cons

The main drawback and con of Coinbase is that its fees are slightly high(2).

Other exchanges may be harder to use but have lower fees. Coinbase is charging a high fee for its trusted platform and ease of use.

Coinbase Earn

Coinbase offers staking on coins, meaning you can hold coins with Coinbase and earn money.

Reasons someone may want to stake:

- Earn extra money on crypto instead of just having it sit there

- Compound earnings

Staking, however, comes with risks:

- If Coinbase gets hacked, you could lose your money

Coinbase offers dozens of coins for staking, the most popular of which being:

- Ethereum (3.26%)

- USDC (4.6%)

Security History

Coinbase has never been hacked.

Why does this matter?

Many exchanges have a history of being hacked, which means if you have coins on the exchange you could lose your money.

Coinbase claims to offer several security measures, including:

- Holding all customer assets 1:1: Meaning, that if Coinbase has 1 BTC for you, they hold the coin and don’t lend it out.

- Custom funds in cold storage: Coinbase claims to hold customer funds in cold storage, meaning your coins are stored offline.

- Machine learning: The company monitors unique transactions and pauses them if they look out of the ordinary.

- Two-factor authentication: Coinbase forces its users to use 2-factor authentication. This means before you log in, you’ll need to generate a unique code. This adds extra security to your account.

Coinbase Alternatives

River Financial is a good alternative to Coinbase. It offers a similar experience with lower fees and is very easy to use.

Kraken is another good alternative if you’re looking for somewhere that’s trusted with cheaper fees.

➤ MORE: Coinbase VS River

BuyBitcoinWorldWide writers are subject-matter experts and base their articles on firsthand information, like interviews with experts, white papers or original studies and experience. We also use trusted research and studies from other well-known sources. You can learn more about our editorial guidelines.

- Nasdaq - Coinbase Global, Inc. Class A Common Stock, https://www.nasdaq.com/market-activity/stocks/coin

- Coinbase - Coinbase pricing and fees disclosures, https://help.coinbase.com/en/coinbase/trading-and-funding/pricing-and-fees/fees

- Reuters - Coinbase new disclosure does not mean firm faces bankruptcy risk, says CEO, https://www.reuters.com/business/finance/coinbase-ceo-says-new-disclosure-does-not-mean-firm-faces-bankruptcy-risk-2022-05-11/